Medical expense insurance, offered through commercial insurers, can be broken down into three basic classes of coverage:

The original, and most common, form of health insurance is called basic medical expense insurance. It’s also known as first dollar coverage because it pays a medical claim starting with the first dollar of covered expense, up to the policy’s maximum benefit.

Basic medical expense policies can be subcategorized into three different policies:

These policies provide benefits on a reimbursement basis, paying actual hospital expenses. They commonly cover care in a semi-private room, up to a stated dollar maximum, for a maximum number of days.

These policies cover many of the extra charges associated with a hospital stay. Covered items can include operating room charges, physician’s fees, medicine, diagnostic lab tests, x-rays, and ambulance service charges. The benefit amount is commonly expressed either as:

These policies pay surgical expenses for treatment received in a hospital or on an outpatient basis. Most basic medical plans provide benefits based on a schedule of operations. This schedule states how much will be reimbursed for each type of procedure.

Historically, insureds might own one, two, or all three of these basic coverages. Together, they became commonly known as the base plan of coverage. Although these coverages are still available today, their low maximum benefits are often inadequate when an insured faces a catastrophic event. To meet the need for higher limits, insurers designed Major Medical plans.

As the name implies, Major Medical provides coverage for major medical expenses. These policies typically have maximum benefits of several million dollars, and they cover a broad range of expenses.

Major Medical plans are also characterized by:

Deductible amounts can range from $50 to several thousand dollars, depending on the insured’s preference. In general, the higher the deductible, the lower the premium.

A deductible can be applied on a calendar year basis or per medical occurrence. The calendar year basis is more common. This means one deductible applies to any and all medical expenses incurred during that calendar year.

Many plans offer a family deductible. For example, a plan might stipulate that a $100 deductible applies to any one family member, but that the total deductible for the entire family - regardless of how many family members receive treatment - will not exceed $250.

Another cost-sharing feature is co-insurance. For covered expenses in excess of the deductible, a Major Medical plan will generally pay 80%, leaving the policy owner responsible for the remaining 20%.

To protect insureds from the impact of a catastrophic illness or injury, many plans incorporate a stop-loss feature. Stop-loss (also called max out of pocket) caps the amount of expenses subject to the co-insurance requirement. Any expenses in excess of the stop-loss cap are paid by the insurer at 100%. The stop-loss provision is activated when the insured’s out-of-pocket expenses reach a specified amount.

Underwriting is also a standard feature of Major Medical policies. Applicants may be required to provide health information, and coverage can be issued on a standard or adjusted basis depending on the insurer’s risk assessment.

As the industry evolved, the three policies making up the traditional base plan - hospital, surgical, and regular medical expense - were often paired with a Supplemental Major Medical policy to provide broader coverage.

In this arrangement:

For example, if the base plan paid up to $50,000 and there was a $1,000 corridor deductible, the insured would pay the next $1,000 out of pocket before Major Medical benefits kicked in.

Eventually, these separate components were combined into a single policy known as Comprehensive Major Medical. This type of policy typically uses a single overall deductible from the start, without a separate base layer or corridor deductible.

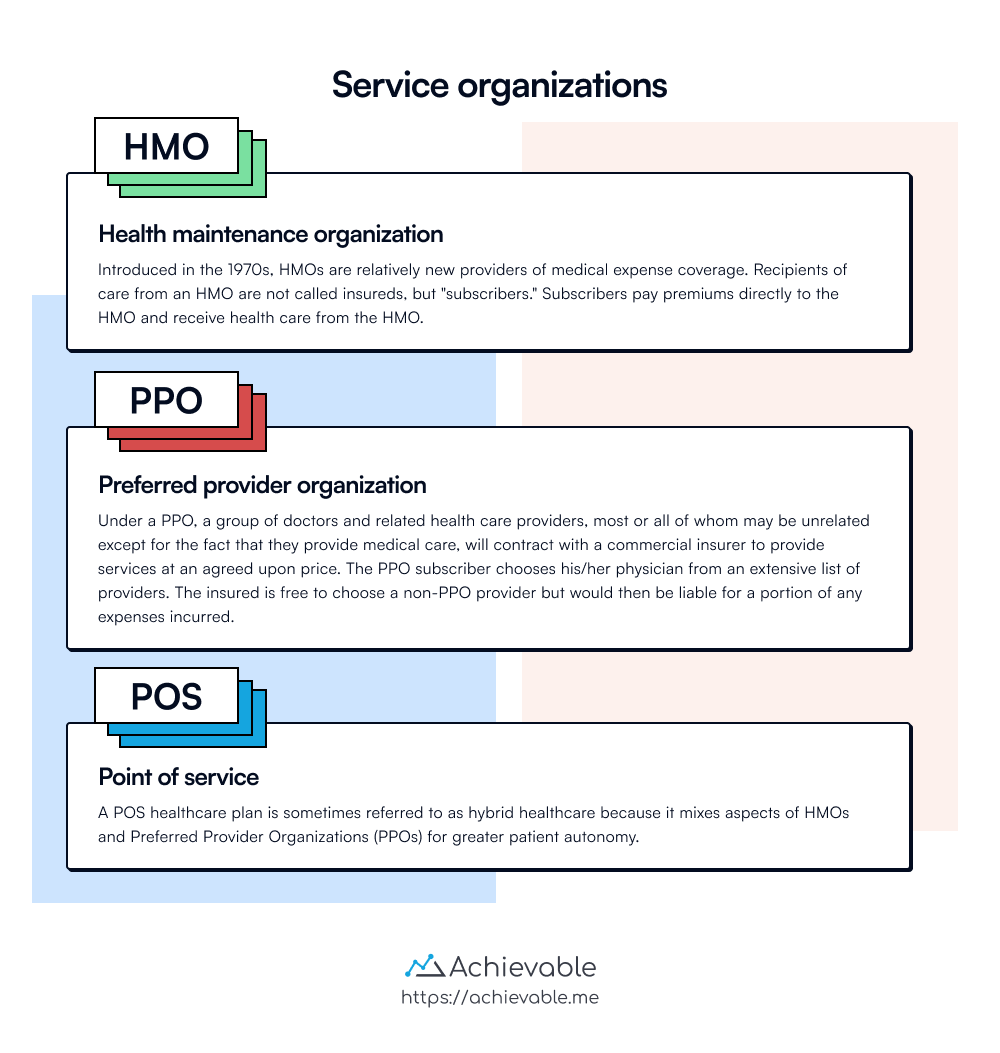

Introduced in the 1970s, Health Maintenance Organizations (HMOs) are relatively new providers of medical expense coverage. People who receive care from an HMO are not called insureds, but subscribers. Subscribers pay premiums directly to the HMO and receive health care from the HMO. HMO premiums represent a prepayment of services, and these organizations do not function on a reimbursement basis.

The emphasis of an HMO is preventive health care. As a result, an HMO may cover care that is not usually covered under commercial policies. A typical example is an annual physical examination.

HMOs attempt to curb the cost of medical care by preventing illness and detecting problems early. Examples include:

Ongoing management of chronic conditions can also help prevent medical crises and emergency hospitalization. Examples include managing asthma, diabetes, or blood pressure. These are also examples of preventative care.

HMO subscribers are required to obtain medical treatment from the HMO or from a provider approved by (contracted with) the HMO. This is a key distinguishing characteristic of an HMO.

To contract with an HMO, a provider negotiates a capitation. Capitation means a provider is paid a set fee per HMO subscriber the provider services, regardless of how much treatment the subscriber requires. After receiving the fee, the physician is responsible for providing a specific range of medical services to a specific number of subscribers.

To ensure subscribers use HMO providers, the system requires that (except for emergencies) the subscriber first see a primary care provider, also known as a gatekeeper. The gatekeeper either provides the appropriate care or refers the subscriber to a specialist who is contracted with the HMO.

A common criticism of HMOs is that subscribers must obtain treatment directly from the HMO (or a contracted provider). This can limit the subscriber’s control over which physician provides treatment. Preferred Provider Organizations (PPOs) were developed mainly in response to this concern.

Under a PPO, a group of doctors and related health care providers - most or all of whom may be unrelated except for the fact that they provide medical care - contract with a commercial insurer to provide services at an agreed-upon price.

The PPO subscriber chooses a physician from an extensive list of providers. The insured is free to choose a non-PPO provider, but would then be liable for a portion of any expenses incurred.

A Point-of-Service (POS) plan is a type of managed healthcare arrangement that combines features of both HMOs and PPOs.

POS plans are sometimes called “hybrid” healthcare arrangements because they blend the cost-control emphasis of HMOs with the flexibility of PPOs. This gives subscribers more autonomy in choosing providers while still encouraging the use of in-network services.

A firm that provides administrative services for employers and other associations with group insurance policies is the third-party administrator (TPA). The third-party administrator acts as a liaison between the insurer and the employer in matters such as certifying eligibility and processing claims.

If claim costs are fairly predictable, an employer may consider self-funding a health care plan. With a self-funded plan, an employer (not an insurance company) provides the funds to make claim payments and uses third-party administrators to facilitate the claims process.

Medical expense insurance consists of several categories of coverage provided by commercial insurers:

Basic Medical Expense insurance, also known as first dollar coverage, includes:

Hospitalization Room and Board policies provide benefits for hospital expenses in a semi-private room within specific limits. Miscellaneous Expenses policies cover extra charges associated with a hospital stay, such as operating room charges or physician fees. Surgical Expense policies pay surgical expenses for treatments received in hospitals or outpatient facilities based on a schedule of operations.

Major Medical provides coverage for major medical expenses, requires a deductible and co-insurance, and may incorporate a stop-loss provision. Comprehensive Major Medical combines the basic plan coverage without a deductible up to a specified limit, then triggers Major Medical coverage.

Health Maintenance Organizations (HMOs) emphasize preventive health care, with subscribers receiving care directly from the HMO or contracted providers. Preferred Provider Organizations (PPOs) offer more flexibility in choosing providers at predetermined rates.

Sign up for free to take 16 quiz questions on this topic