Section 125 Plans and Limited Policies

Cafeteria plans (Section 125 plans)

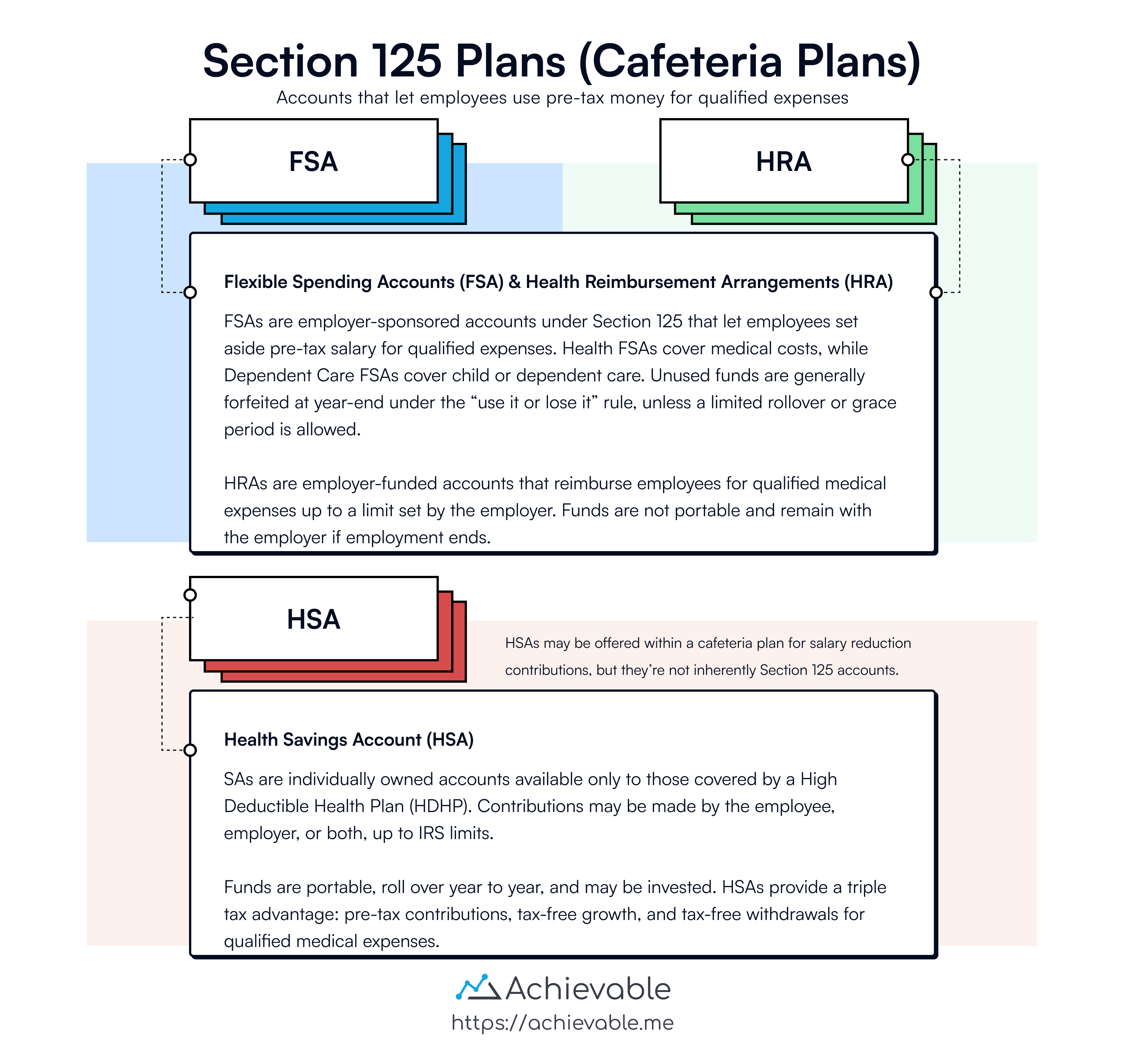

Cafeteria plans, also called Section 125 plans, are employer-established programs that let employees set aside pre-tax income for medical expenses and other qualified costs. The goal is to reduce taxable income while helping you pay for health-related expenses.

The most common type of Section 125 account is the Flexible Spending Account (FSA). Other accounts - such as Health Savings Accounts (HSAs) and Health Reimbursement Arrangements (HRAs) - are often offered through employers, but they are not themselves Section 125 plans.

Below, you’ll take a closer look at these different types of accounts and how they work.

Flexible spending accounts (FSA)

A Flexible Spending Account (FSA) is an employer-sponsored account that lets you set aside pre-tax earnings to pay for:

- Qualified medical expenses (Health FSA), or

- Dependent care expenses (Dependent Care FSA)

FSAs are subject to the “use it or lose it” rule. That means unused balances are forfeited at year-end. Some employers may allow either a short grace period or a small carryover of unused funds (up to IRS limits).

Contributions may be made by the employee through salary reduction agreements and are excluded from taxable income. Distributions are tax-free if used for qualified expenses.

Health savings account (HSA)

Health Savings Accounts became available January 1, 2004. A Health Savings Account is a trust established for the purpose of paying qualified medical expenses on a tax-favored basis.

HSAs are available to any employer or individual who has a high-deductible health insurance policy. HDHP deductibles and HSA contribution limits are set annually by the IRS and are adjusted for inflation (“up to IRS limits”). Exams will not require you to memorize the exact dollar amounts.

HSAs are similar to the older Medical Savings Accounts (MSAs), but they are more flexible and widely used today.

An individual may establish the account (FSAs and HRAs are employer-established), and most insurance companies, banks, and brokerage firms can act as trustee.

In an HSA, funds not used for current health care expenses are not forfeited. Instead, they remain in the account (even when changing jobs). Unused contributions continue to grow on a tax deferred basis and may be placed in various investments.

Qualified medical expenses are defined by the IRS. Examples include hospital bills, doctor visits, prescription drugs, and (since 2020) certain over-the-counter medications and menstrual care products. Vitamins and general supplements are not qualified unless prescribed by a doctor.

Other limited policies

Prescription coverage

- This coverage is usually offered as an optional coverage on a health insurance policy. Typically, an insured with prescription drug coverage will present an insurance card to the pharmacy and pay a small amount (co-payment) per prescription. The pharmacy will submit a bill for the balance to the insurance company.

Vision care

- Vision coverage is not readily available in the individual market, but it’s more common as part of a group benefit package. A typical policy will cover the cost of an annual eye exam and eyeglasses or contacts every two years.

Specific disease (dread disease)

- These policies are commonly sold via correspondence (television, newspaper, or direct mail). Specific disease policies are written to cover a single “dread disease,” like cancer. This type of policy covers only that specific disease, but it pays in addition to any other coverage for cancer that may be in force (medical expense or Medicare). The benefit payable is a stated amount on a daily, weekly, or monthly basis and is not related to expenses incurred or to wages lost while the insured is being treated for the named disease.

Hospital confinement

- Much like a specific disease policy, the benefit of a hospital confinement policy is a stated amount, such as a fixed daily dollar amount, while the insured is hospitalized. However, the benefit is paid regardless of the cause of hospitalization and is in addition to any other coverage in force.

Lesson summary

Cafeteria plans (Section 125 plans) are established by employers to allow employees to defer pre-tax earnings into designated accounts for medical expenses. The most common account offered under these plans is the Flexible Spending Account (FSA).

- FSAs may be set up for health care or dependent care expenses, using pre-tax dollars.

- Any leftover money at the year end is forfeited to the company under the “use it or lose it” rule.

- Contributions are excluded from taxable income through salary reduction agreements.

- Distributions are tax-free if used solely for qualified medical expenses, but may be taxable and penalized for other reasons.

Health Savings Accounts (HSAs) are trusts established to pay qualified medical expenses with pre-tax dollars. Here are some points about HSAs:

- Available to employers or individuals with high-deductible health insurance policies.

- Contribution limits are set annually by the IRS, and unused funds can be retained, earning interest.

- Funds are portable, roll over year to year, and remain with the individual even when changing jobs.

Other limited policy types in the health insurance market include:

- Prescription Coverage: Offered on health insurance policies, requires a small co-payment per prescription.

- Vision Care: Common in group benefit packages, covering annual eye exams and eyeglasses/contacts every two years.

- Specific Disease Policies: Cover single diseases like cancer, paying regardless of other coverage, with fixed benefits.

- Hospital Confinement Policies: Provide daily benefits during hospital stays, irrespective of the cause of hospitalization and in addition to other coverage.