While life insurance products can seem endless, they’re built from just two basic forms. Over time, insurers have created many variations of these two forms, so today you can usually find a policy to fit almost any life insurance need.

Life insurance is provided through either a term policy or a permanent (whole life) policy. No matter how complex a policy name sounds, it’s term, whole life, or a combination of the two.

Term insurance

Permanent (whole life)

Because term policies have no savings element, premiums in the younger years of a policy owner’s life are low compared to a whole life policy. However, term insurance premium rates rise each time the policy is renewed. At advanced ages, term insurance rates can be much higher than the rates for a whole life policy, assuming both policies were purchased at a younger age.

Term insurance rates mainly reflect the mortality charge. Because mortality increases with age, term premiums generally increase with age as well.

Term insurance is appropriate when a person has a short-term or temporary need for life insurance. It’s also appropriate when the insured:

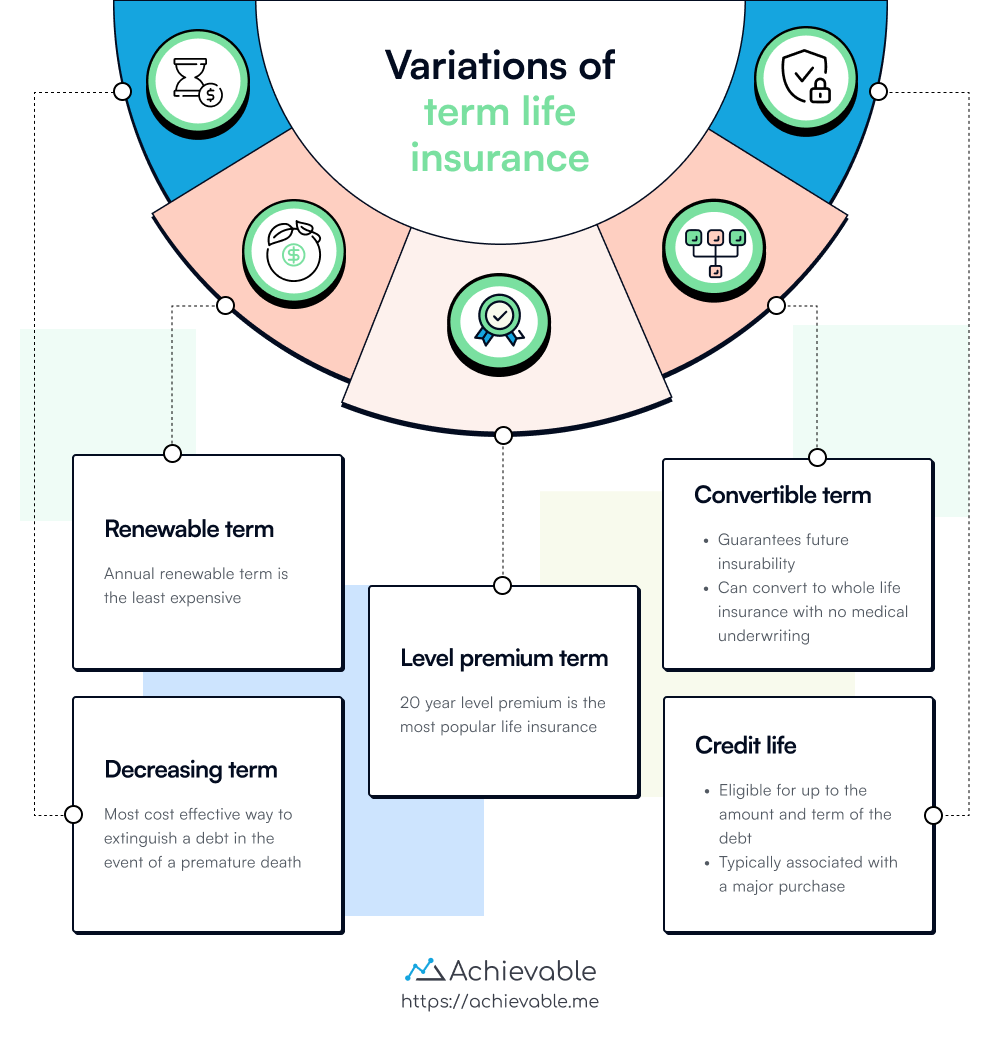

All term policies are issued with a stated termination date. That date may be specified as a number of years or to a stated age. Term policies may be issued for a period as short as one year (annual renewable term).

Term policies with a renewability feature allow the policy owner to renew the policy at the end of the term without providing evidence of insurability. Because the insurer is taking on the risk that the insured’s health may have changed, a renewable term policy is more expensive than a non-renewable policy.

This renewability feature is especially valuable in 20- or 30-year policies. There is always the risk that the policy owner’s health will deteriorate, making them uninsurable. When a policy is renewed, the new premium rate is based on the insured’s attained age.

Level premium term insurance maintains a level face amount and level premiums during the policy’s lifetime. Level term insurance is appropriate when the amount of required insurance stays the same, but only for a limited period of time.

For example, it’s ideal for a parent who wants extra financial protection while their children live at home, but won’t need that extra protection once the children mature and leave home.

Convertibility is a feature that may be added to a term policy. It gives the policy owner the right to convert the term policy to a whole life policy without providing evidence of insurability.

With this type of policy, the premium remains level, but the death benefit decreases each year. The most common use of decreasing term insurance is with mortgages and loans. As the loan balance decreases, the need for protection decreases as well.

Using decreasing term insurance to cover a debt is the basic principle behind credit life insurance. Written on the life of the debtor, the coverage may be individual or group, but it is usually written on a group basis.

Proceeds are payable to the creditor to extinguish a debt. This type is often sold by car dealers, banks, and other creditors. The maximum policy period cannot exceed the life of the loan, and the policy benefit cannot exceed the amount owed. If the loan is paid off early, excess premiums are refunded to the policy owner.

Life insurance products generally fall into two basic forms: term insurance and permanent (whole life) insurance. These forms have evolved over the years to meet various needs, resulting in a wide array of products. Here’s a breakdown:

Further details on term insurance:

Sign up for free to take 11 quiz questions on this topic