To understand how whole life insurance works (and how it differs from term insurance), you first need to understand the amount at risk. The amount at risk is the dollar value of the risk the insured represents to the insurer. In other words, it’s the amount the insurer would have to pay to settle a claim.

As a person ages, the risk of death increases. Insurers reflect this through a mortality charge that generally increases with age. With an annually renewable term (ART) policy, the policy owner pays a higher mortality charge each year, which leads to rising premiums. However, most term life insurance sold today is level term, where the premium stays fixed for a set number of years (for example, 10, 20, or 30), even though the risk of death increases with age.

A term policy does not accumulate cash value. With a $100,000 term policy, the insurer’s amount at risk is $100,000. If the insured dies while the policy is in force, the insurer would have to pay $100,000. Each year, the insured grows older and draws closer to death, so the mortality charge increases and is reflected in the premium.

With permanent insurance, the net amount at risk decreases each year. In a whole life policy, the amount at risk at any point in time is the difference between the policy’s face amount and its cash value. The cash value is a reserve fund created by excess premiums paid in the early years. Those excess premiums are used to offset the need for higher premiums in later years.

As cash value increases, the insurer’s amount at risk decreases. As the amount at risk decreases, a larger portion of the level premium can be allocated to the policy’s cash value. At the same time, the risk of death (and the mortality charge) increases with age. These two forces counterbalance each other, which is why whole life premiums can remain level. Insurers charge more than is needed to cover mortality risk in the early years, and later charge less than the mortality risk would otherwise require.

Cash value builds up in the early years of a policy to subsidize the cost of protection in later years. No federal or state taxes are imposed on the accumulation of cash value inside a life insurance policy.

Whole life policies are structured so that cash value gradually approaches the face amount by age 100 (or 121 in many modern policies). When the cash value equals the face amount, the insurer’s amount at risk is $0 and the policy matures. Because the face amount and cash value are equal, there’s no longer a reason for the insurer to hold the cash value, so the insurer pays the insured the face amount of the policy.

A key feature of cash value is that the policy owner may access it through a policy loan. Insurers charge a nominal interest rate on policy loans, and the maximum rate is regulated by state law. If the insured dies before the loan is repaid, the death benefit paid to the beneficiary is reduced by the loan balance plus any accrued interest.

In real-world practice, policy loans are an important concept. If you sell whole life insurance, you’ll use this feature often. For the pre-license exam, you should know that:

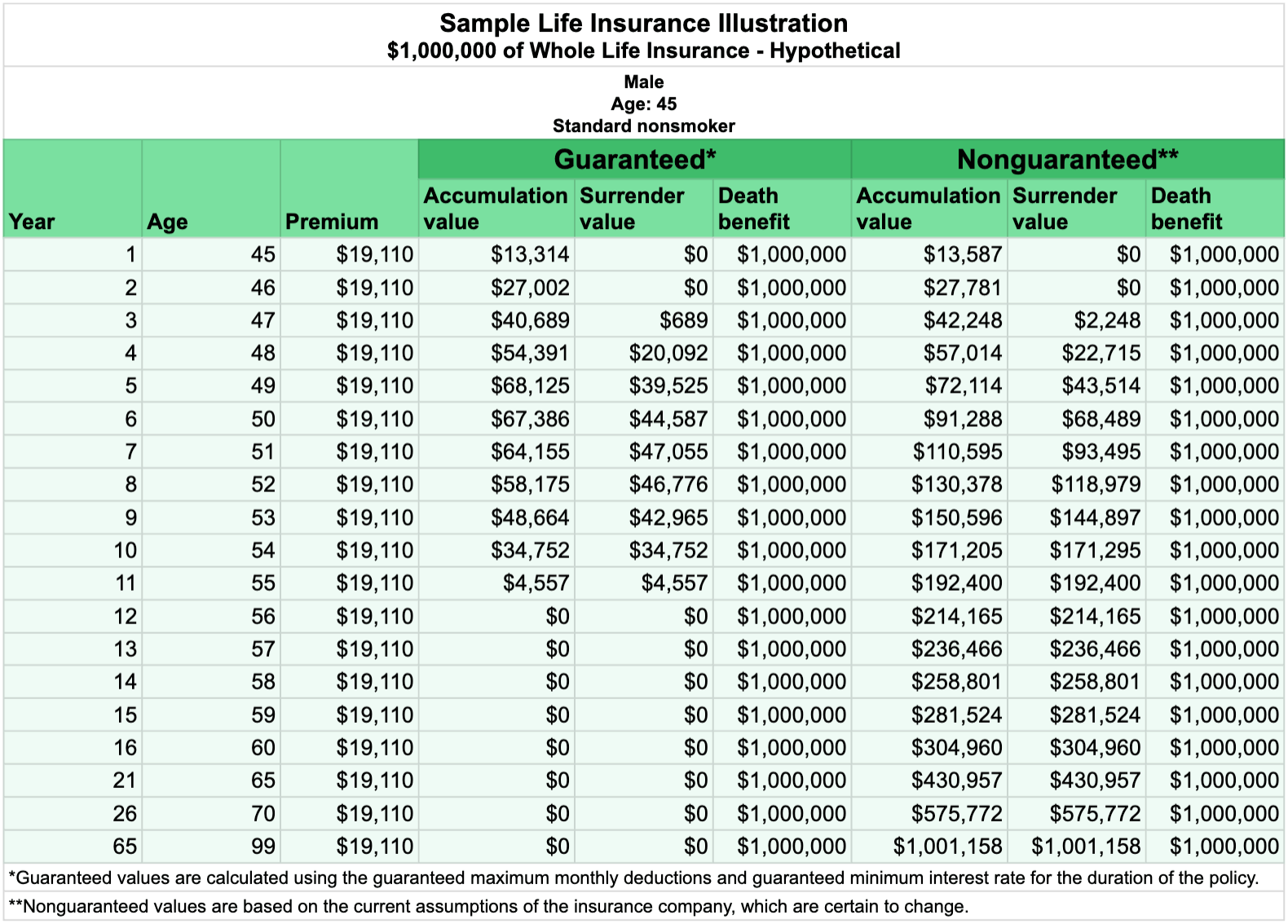

An illustration shows how nonguaranteed benefits may change as interest rates and other factors change, and it also shows what the insurer guarantees.

An illustration typically has two key components:

The guaranteed illustration. This is the legally required disclosure of a worst-case scenario. It outlines policy performance based on the carrier’s minimum filed credit rates for a particular policy and the maximum mortality charges using the appropriate commissioner’s standard mortality table (such as the 2001 or 2017 CSO, depending on the policy’s issue date).

The current illustration. This is the insurer’s representation of policy performance based on credit rates and mortality charges currently in effect.

These give an overview of the main elements of the policy and provide an opportunity to confirm that the policy’s premium stream and benefit projections match the client’s needs and ability to pay.

It advises readers that the illustration is not an estimate of future values and that actual results could be more or less favorable.

This shows a numeric summary of the illustration in 5- and 10-year increments. The applicant signs a statement acknowledging that the nonguaranteed elements are subject to change. The producer signs to confirm that he or she has explained that the nonguaranteed elements are subject to change.

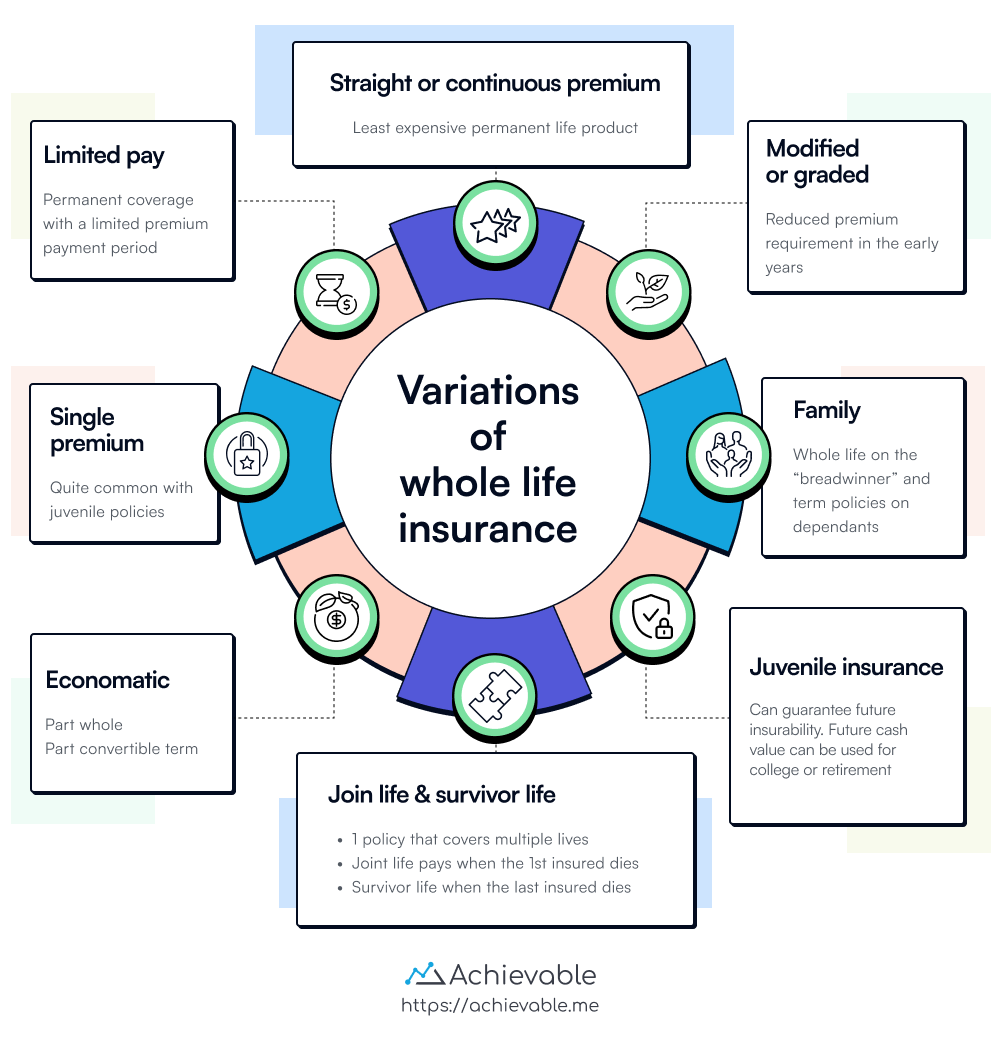

The most common form of whole life insurance is the straight life policy, with equal premium payments spread out for the life of the insured (or to age 100 for most older policies, or 121 for many newer policies).

This is a form of whole life insurance in which premiums are lower for a specified period of time (for example, 5 years). After that period, the premium increases for the remainder of the policy term. This is popular with people who have a smaller budget in their younger years. Because early premiums are reduced, cash values accumulate more slowly than with a straight life policy.

This is a form of modified whole life, except that premiums increase steadily rather than in one single jump. Cash values accumulate very slowly because the premium in the early years can be as much as 50% less than that of a comparable straight life policy.

With a limited pay whole life policy, the premium-paying period is shorter than with a straight life policy, although coverage continues for the insured’s entire life. Premium payments are higher than they are for a comparable straight life policy. As a result, cash values accumulate faster than they do with a straight life policy.

The most common forms of limited pay policies are the 20-pay life, in which premiums are paid for 20 years, and LP65, in which premiums are paid to age 65.

It’s rare, but it is possible to pay up a policy with one premium payment, which creates an immediate cash value.

Although term and whole life insurance are the two basic forms of insurance, insurers have developed policies that combine features of both. Known as combination policies, they are designed to meet very specific life insurance needs.

Economatic whole life is a whole life policy with a convertible term rider that uses dividends to convert the term to paid-up whole insurance over time.

The most common form of combination policy is the family policy. A whole life policy is issued to the breadwinner, and level term policies are issued on the spouse and each child. As new children are born, they are automatically covered. A convertibility option is added to each term policy to protect the children’s insurability.

The purpose of a family income policy is to guarantee that income will be provided to surviving family members if the breadwinner dies prematurely. It is a decreasing term policy attached as a rider to an underlying whole life policy. The rider provides the funds needed to pay a predetermined income to the beneficiary for the remainder of a specified period of time.

For example, if Zack Luna buys a 15-year family income policy and dies 2 years later, the monthly income benefit would be paid for the following 13 years. If he dies 7 years after issuance, payments would be made for the remaining 8 years. If he dies at or after 15 years, there would be no income benefit payments.

A family maintenance policy is similar to a family income policy, but it provides monthly income for a set period of time. It uses a level term policy rider added to the underlying whole life rather than a decreasing term rider.

Using the example above, the family maintenance policy would provide monthly income for 15 years, whether the breadwinner dies today or in 14 years. In the example above, if the breadwinner died in 14 years, the family would receive monthly income for one year. With a family maintenance policy, it would continue for 15 years from the date of death.

To understand whole life insurance, you need to understand the concept of amount at risk. Here are some key points:

Cash value features include tax advantages and policy loans. Here are some details:

Whole life policies have various forms such as Straight Life, Modified Life, Graded Premium Whole Life, Limited Pay Whole Life, and Single Pay Life. Each type has unique characteristics and benefits. The features of these policies can be seen in policy illustrations, which include guaranteed and current illustrations. Additionally, combination policies like Family Policy, Family Income, and Family Maintenance offer specialized coverage to meet specific insurance needs by combining features of both term and whole life insurance.

Sign up for free to take 15 quiz questions on this topic