Payouts and Advanced Options

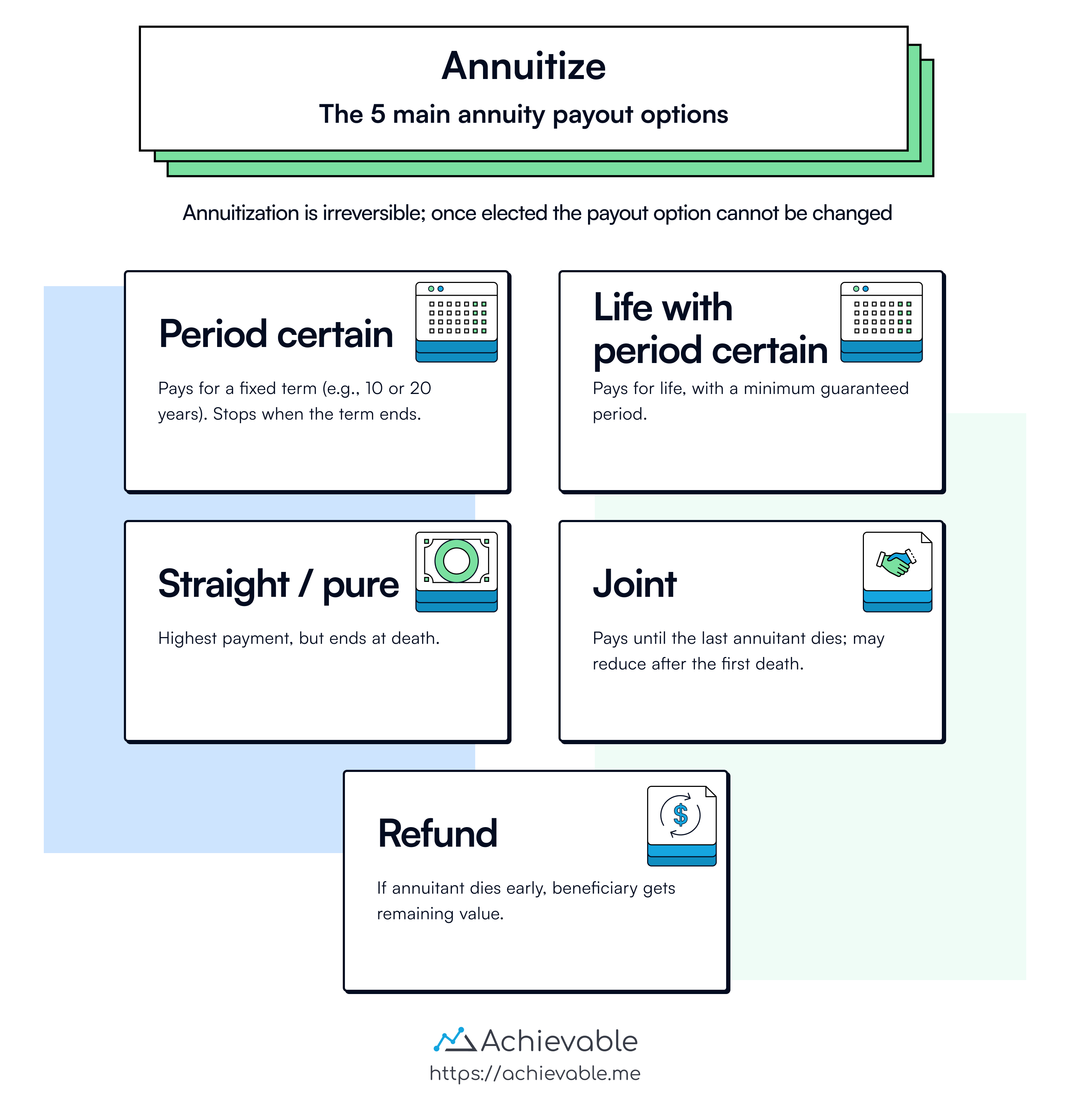

The available annuity payout options are as follows:

-

Life income (straight): This option typically provides the highest monthly payment, but it also carries the most longevity risk for the insurer. Payments are guaranteed for the annuitant’s lifetime and stop at the annuitant’s death.

-

Period certain (fixed period annuity): This option provides payments for a fixed period (for example, 10 or 20 years). If the annuitant dies during that period, a beneficiary receives the remaining payments. If the annuitant lives beyond the period, payments stop when the period ends.

-

Life annuity with period certain: Payments are guaranteed for the annuitant’s lifetime or for a specified period (for example, 10 or 20 years), whichever is longer. If the annuitant dies during the guaranteed period, the beneficiary receives the remaining payments. If the annuitant lives beyond the period, payments continue for life.

-

Refund: This is the most conservative option and typically has the lowest payments. If the annuitant dies before receiving payments equal to the contract’s value at annuitization, the beneficiary receives the remaining balance. Refunds may be paid either in a lump sum (cash refund) or in continued installments (installment refund).

-

Joint life: This payout option covers two or more people, commonly spouses. The contract pays monthly as long as at least one annuitant is living. Depending on the contract, the payment may stay level or be reduced after the first annuitant’s death.

Taxation of annuity payments differs from withdrawals during the accumulation stage. Once a contract has been annuitized, the 10% early withdrawal penalty no longer applies because payments are treated as a scheduled annuity stream, not as withdrawals.

For income taxes, only the portion of each payment that represents growth is taxable. Fixed annuity payments stay the same each month, while variable annuity payments may change based on investment performance.

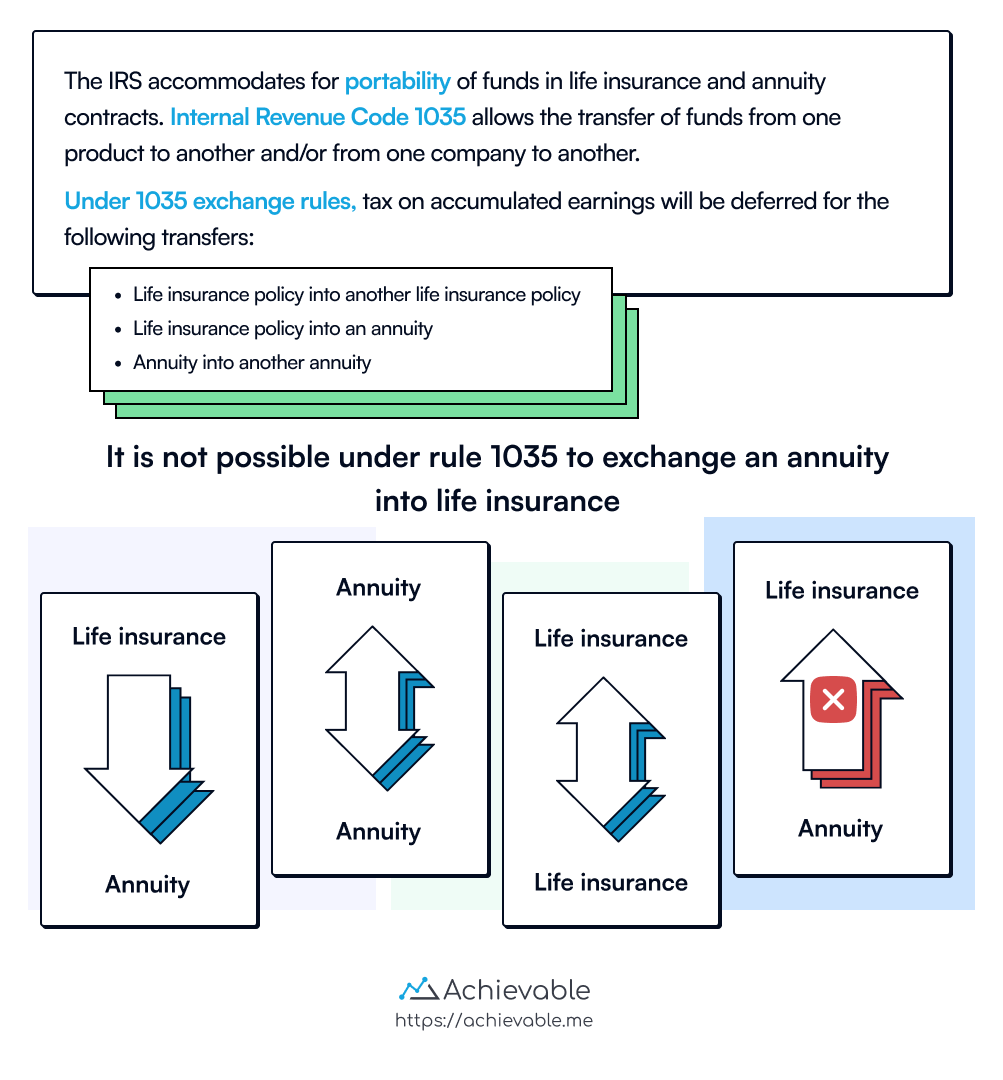

The IRS provides portability for certain life insurance and annuity contracts. Internal Revenue Code 1035 allows the transfer of funds from one product to another, or from one company to another. Under 1035 exchange rules, tax on accumulated earnings is deferred for the following transfers:

- Life insurance policy into another life insurance policy

- Life insurance policy into an annuity

- Annuity into another annuity

Equity indexed annuities

Equity indexed annuities are fixed annuities that guarantee against loss of principal if held to term. With an equity indexed annuity, interest credited is linked to the upward movement of a designated index, such as the Standard and Poor’s 500 (S&P 500).

- If the index moves upward, the interest rate is based on some portion of the increase.

- If the index moves downward, the equity indexed annuity does not lose value.

Market value adjusted annuities

Another fixed annuity product with a market-driven feature is the market value adjusted annuity. Unlike an equity indexed annuity (where interest is linked to an index), a market value adjusted annuity credits a fixed interest rate. The market value adjustment feature applies only if the contract is surrendered before the contract period expires.

If a market value adjusted annuity owner surrenders the contract early, both a surrender charge and a market value adjustment apply.

- If interest rates decrease during the contract period, the adjustment is positive and may add to the contract’s surrender value.

- If interest rates increase during the contract period, the adjustment is negative and may increase the contract’s surrender charge.

Lesson summary

IRS rules under Code 1035 allow portability of funds between life insurance and annuity contracts, deferring tax on certain transfers such as life-to-life, life-to-annuity, and annuity-to-annuity. Transfers from an annuity into life insurance are not permitted.

- Equity indexed annuities offer principal protection and interest linked to an index’s upward movement without downside risk.

- Market value adjusted annuities have fixed interest rates but include a market value adjustment feature upon early surrender, impacting surrender values based on interest rate fluctuations.

Available annuity payout options include life income, period certain, refund, and joint life, each offering different tradeoffs in payment amount, guarantees, and beneficiary protection.