The Affordable Care Act (ACA), signed into law in 2010, was designed to make health insurance easier to get and more consistent across the country. Before the ACA, many people were denied coverage because of preexisting conditions, charged more based on their health, or faced caps on how much their plan would pay. The law added new consumer protections and created a framework for expanding coverage through Medicaid, private plans, and subsidized options.

The ACA also aimed to increase insurer accountability, standardize coverage rules, and help more Americans afford a basic level of health care. In the insurance industry, it significantly changed how individual and small group policies are priced, sold, and regulated. Many core provisions still appear on state licensing exams, even though some federal mandates (such as the tax penalty for not having coverage) are no longer enforced.

The ACA introduced insurance reforms that apply to both individual and group health coverage. These rules still show up on licensing exams and represent some of the law’s most lasting impacts.

One of the biggest changes was the elimination of preexisting condition exclusions. Before the ACA, insurers could deny coverage or refuse to pay for care related to a person’s health history. Under current law, health plans must accept all applicants regardless of medical background, and they can’t charge higher premiums based on health status.

Another major reform was the requirement for guaranteed issue and guaranteed renewability. New health insurance policies must be offered to anyone who applies and must be renewable each year as long as premiums are paid.

The ACA also requires health plans to cover dependent children up to age 26, even if the child isn’t a student or is married. This rule applies to both individual and group plans.

To protect consumers from catastrophic medical bills, the ACA prohibits plans from placing annual or lifetime dollar limits on coverage for essential health benefits. In other words, if a service falls within one of the required essential benefit categories, the plan can’t set a hard dollar cap on what it will pay.

In addition, the law requires that certain preventive services must be covered without cost-sharing. This includes screenings, vaccines, and wellness visits recommended by national public health agencies. The goal is to encourage early detection and reduce long-term costs by making routine care more accessible.

Finally, the ACA sets a 90-day maximum on waiting periods for employer-sponsored plans. Once an employee is eligible for coverage, the plan can’t delay the start date beyond 90 calendar days, regardless of the employer’s internal onboarding schedule.

These reforms form the foundation of what the ACA changed - and they’re common in exam questions about what’s covered, when coverage must be offered, and who must be eligible.

One of the most testable ACA requirements is that certain health plans must cover a standardized set of services called Essential Health Benefits (EHBs). EHBs apply to individual and small group plans, including those offered through the Marketplace. Large group plans aren’t required to cover all ten EHB categories, but if they do cover them, they may not impose dollar limits on those benefits.

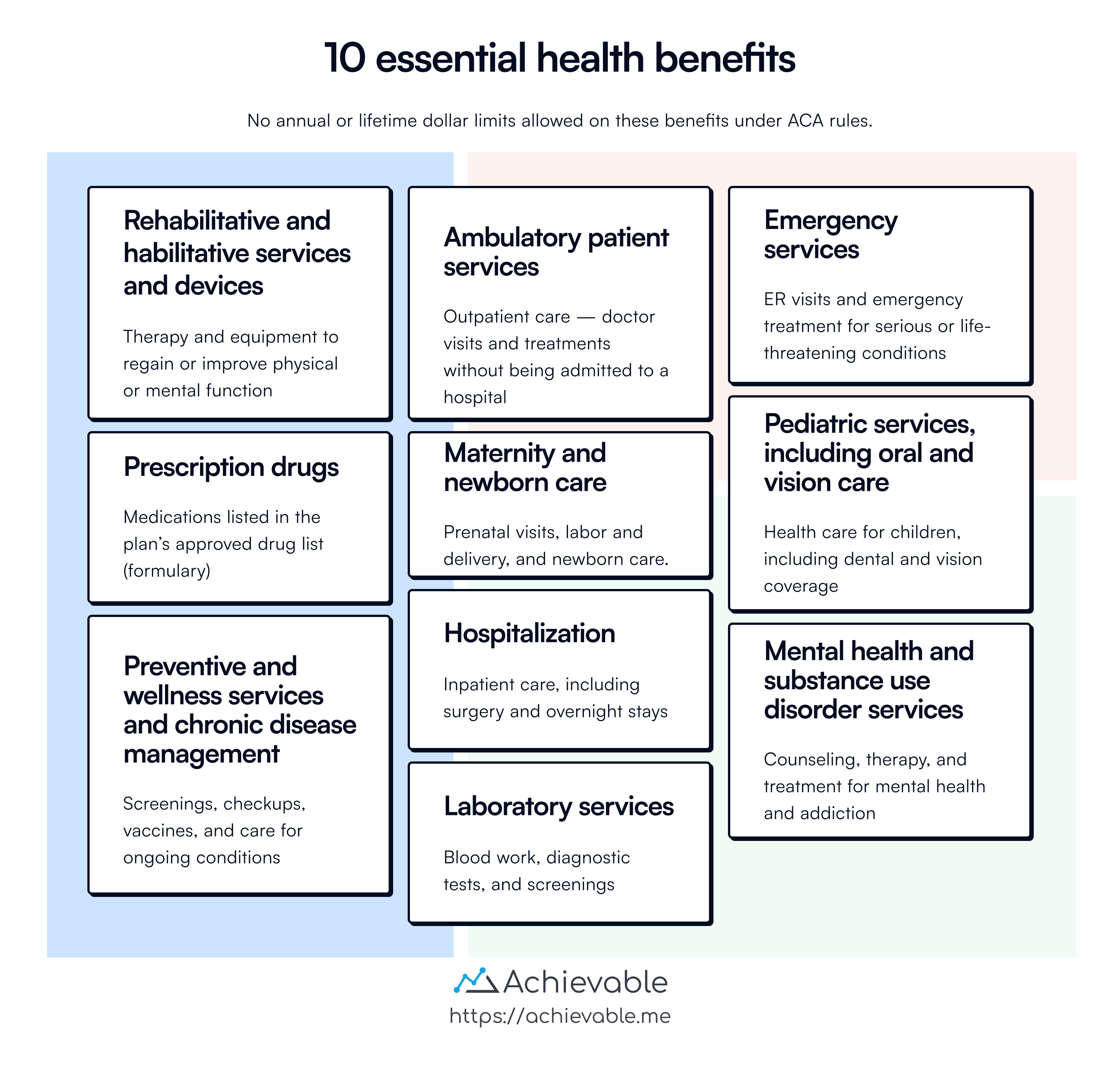

The law defines ten categories of EHBs that must be included:

Exams often ask you to identify which services are required or to spot a benefit that doesn’t qualify. Knowing all ten categories - especially maternity care, mental health, and preventive services - is important.

Just as important: insurers can’t place annual or lifetime dollar limits on these benefits. Plans can still use cost-sharing (such as deductibles or copays), but the no-dollar-limit rule applies once a service is classified as an essential health benefit.

The ACA includes rules that apply specifically to employers with 50 or more full-time equivalent employees. These employers must offer minimum essential coverage that is considered affordable to their full-time employees and their dependents. If they don’t, and at least one employee receives a subsidy through the health insurance Marketplace, the employer may be subject to a tax penalty.

This rule is commonly called the employer shared responsibility provision, but licensing exams often focus on the 50-employee threshold and the conditions that trigger a penalty.

To meet the requirement, the coverage offered must meet two basic tests:

A full-time employee is generally defined as someone who works at least 30 hours per week or 130 hours per month. Employers must also include part-time hours in their calculation when determining whether they meet the 50-employee threshold (this is where “full-time equivalent” matters).

If an employer meets the size threshold but fails to offer qualifying coverage, and a full-time employee qualifies for a premium tax credit on the Marketplace, the employer can be penalized - even if most employees are covered.

This topic is often tested through scenario questions, so keep the 50-employee threshold and the connection between employee subsidies and employer penalties clear.

The ACA created a Health Insurance Marketplace (also called an exchange) where individuals and small businesses can compare and purchase private health plans. Most states use the federal platform at HealthCare.gov, while others run their own exchanges.

Marketplace plans must meet ACA standards, including coverage of essential health benefits and limits on out-of-pocket costs. These plans are grouped into four metal tiers based on how costs are shared between the enrollee and the insurer:

The tier reflects the plan’s actuarial value, meaning the percentage of expected health costs the plan will cover. It doesn’t describe the quality of care or provider access.

Licensing exams often test your understanding of subsidies tied to Marketplace enrollment:

To receive either subsidy, an applicant must enroll in a Qualified Health Plan (QHP) through the Marketplace.

Exams may also test rules around nonpayment. If a person receiving a premium tax credit misses a payment, but has already paid at least one full month’s premium, the ACA provides a 90-day grace period before the policy can be terminated.

The ACA set rules for when individuals can enroll in or change health plans. You need to know the difference between the Open Enrollment Period (OEP) and the Special Enrollment Period (SEP).

The Open Enrollment Period is the standard window each year when anyone can apply for coverage through the Marketplace or an individual health plan. The federal OEP typically runs from November 1 to January 15, but some states set their own timelines. During this period, no special reason is needed to apply.

Outside of open enrollment, a person must qualify for a Special Enrollment Period. A SEP is triggered by certain life events, such as:

To use a SEP, individuals usually must act within 60 days of the qualifying event. Licensing exams often test this by asking which events qualify and how long someone has to enroll.

The exam may include questions that require you to distinguish between the ACA, HIPAA, and COBRA. These laws all relate to group and individual health coverage, but they serve different purposes and still operate alongside each other.

The ACA eliminated preexisting condition exclusions for all ages and removed the need for creditable coverage. It also standardized rules for coverage eligibility and essential benefits. In contrast, HIPAA focused on portability, requiring group plans to reduce or waive preexisting exclusions when a person had prior continuous coverage. HIPAA also introduced federal privacy protections, giving individuals rights over how their medical information is used and disclosed.

COBRA provides continuation of group coverage after qualifying events like job loss, divorce, or a dependent aging out. The ACA didn’t replace COBRA - it added protections for people entering or leaving coverage.

In short:

Exams may test these as multiple-choice scenarios or ask which law applies in a given situation.

The Affordable Care Act (ACA) expanded access to health insurance and added key consumer protections. It banned preexisting condition exclusions, required dependent coverage to age 26, and mandated guaranteed issue and renewability.

Marketplace plans are offered in four metal tiers and must cover 10 Essential Health Benefits (EHBs) without annual or lifetime dollar limits. Preventive care is free. Subsidies include APTCs (premium help) and CSRs (for Silver-tier plans only).

Large employers (50+ FTEs) must offer affordable coverage or face penalties. Enrollment is allowed during OEP or a SEP triggered by qualifying life events.

For the exam, focus on what the ACA changed:

Sign up for free to take 5 quiz questions on this topic