The concept of risk is why insurance exists. In a good year, you might have no medical expenses at all. But if you’re hit by a bus, your medical bills could easily exceed $500,000. Risk is part of life, and you can’t eliminate it completely - even if you’re willing to spend a lot of money.

For example, the only way to eliminate auto-related injuries is to eliminate automobiles. So a practical response to risk usually combines two approaches:

In exchange for a premium, the insurer pays a claim if a specified contingency occurs, such as death or medical bills. The insurer can offer this protection against financial loss by pooling risks from a large group of similarly situated individuals (exposure units). With a large pool, the laws of probability indicate that only a small fraction of the insured population will die or be hospitalized in a given year.

For example, if each of 100,000 individuals independently faces a 0.5% risk in a year, then on average 500 will have losses. If each of the 100,000 people paid a premium of $1,000, the insurance company would collect a total of $100 million - enough to pay $200,000 to anyone who had a loss (assuming 500 people had a loss).

Insurance works through the statistical concept of the Law of Large Numbers. This law explains that when a large number of people face a low-probability event, the actual proportion experiencing the event tends to be close to the expected (mathematical) proportion. For instance, with a pool of 100,000 people who each face a 0.5% risk, the Law of Large Numbers indicates that 500 people or more will have losses during the same period only 1 time in 1,000.

Insurance is a business. It only works for companies that can maintain financial strength while paying out claims. Insurance helps you manage risk by protecting you from events that could significantly affect your financial future. At the same time, the Law of Large Numbers helps insurance companies by making the total number of claims they’ll pay each year reasonably predictable.

When you flip a coin, the probability it will land on heads is 50%, and the probability it will land on tails is 50%. Now suppose you flip a coin 10 times and it lands on heads 9 times. Does that mean the calculated probability was wrong?

No. With a small sample (like 10 coin tosses), actual results can vary a lot from what you’d expect. But if you flipped the coin 10 million times (a very large sample), the results would be extremely close to 50% heads and 50% tails.

Although the ability to predict future losses with some degree of accuracy is critical to insurance, some types of perils are less predictable. When these perils cause losses, they may not create a stable pattern that insurers can use to forecast future losses. In a hurricane, airplane crash, or epidemic, many people may suffer losses at the same time.

To manage this, insurance companies spread risk:

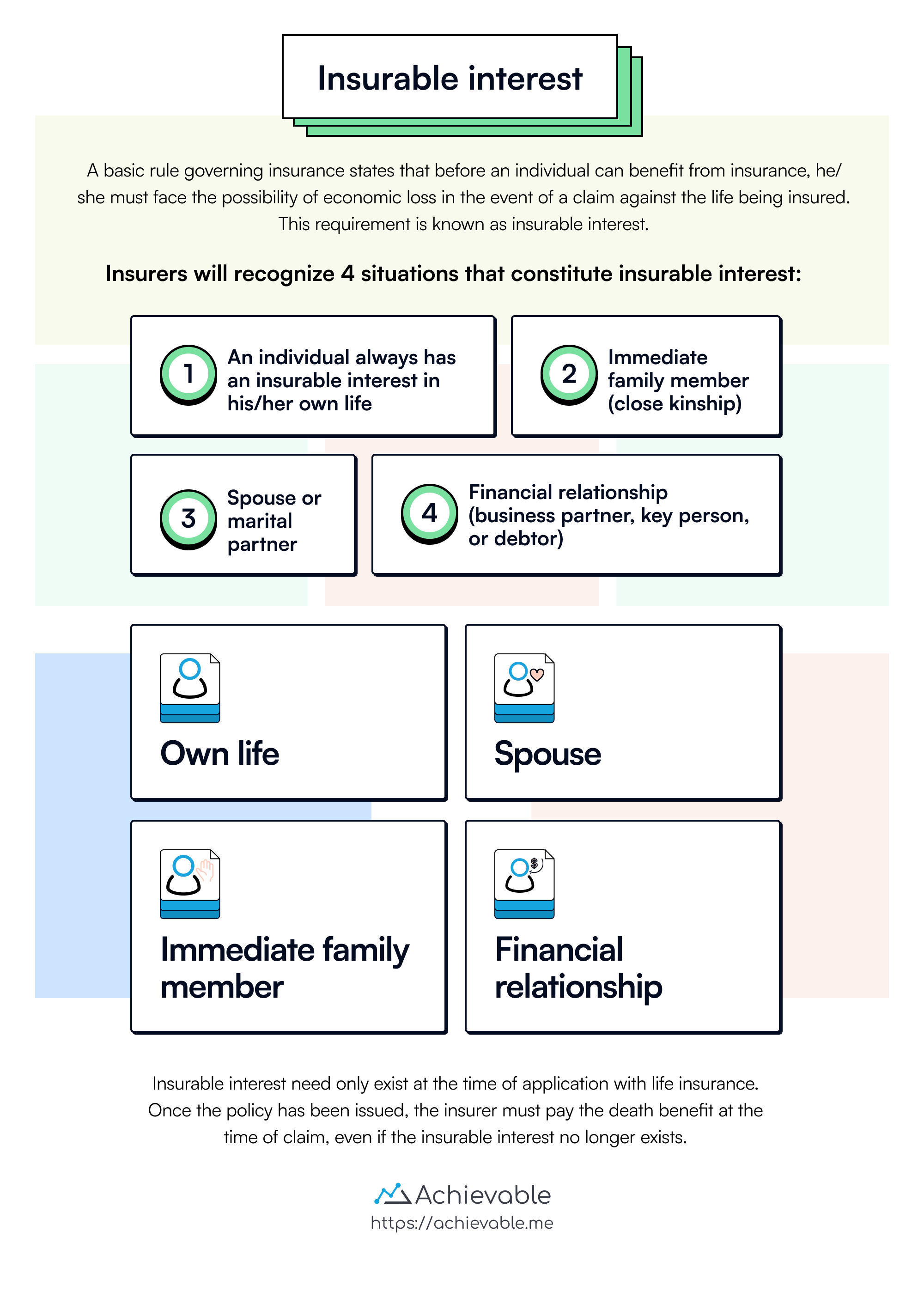

Another basic rule of insurance is that before you can benefit from insurance, you must face the possibility of economic loss if a claim occurs against the life or property being insured. This requirement is called insurable interest.

Insurers recognize several common situations in which insurable interest exists:

Own life - A person always has an insurable interest in their own life.

Spouse or marital partner - Marriage or legal partnership establishes insurable interest.

Immediate family members - This includes close blood relatives such as parents, children, or siblings.

Financial relationships - Insurable interest also exists when there is a financial stake in the continued life of another, such as a business partner, key employee, or debtor.

Important: For life insurance, insurable interest must exist at the time of application. It does not need to exist at the time of the claim.

Certain risks can’t be transferred through insurance. Insurable risks have characteristics that make the rate of loss fairly predictable, which allows insurers to prepare for the losses that do occur. For a risk to be acceptable to a conventional insurance company, it must meet the following criteria:

1) Loss must be uncertain

The purpose of insurance is to offset the financial loss of a covered event. The need for insurance comes from not knowing what will happen to a particular exposure unit. If a future loss is certain, it is not insurable.

With life insurance, the uncertainty isn’t whether an individual will die. The uncertainty is when that individual will die and what financial obligations will remain when death occurs.

2) Large number of exposure units

Insurance companies can’t predict who will die and when. But by using data from a large number of people, they can predict with reasonable accuracy how many people in a given population are likely to die during a certain period of time. In general, the larger the group, the more accurately the insurer can predict losses for the group.

This is why the Law of Large Numbers helps insurance companies set appropriate premium charges so they can maintain financial strength while paying claims.

3) Loss must pose an economic hardship

If the potential loss doesn’t justify the premium and the underwriting expenses to the insurance company, the risk is not insurable.

4) Loss must be ascertainable

The insurer must be able to measure the loss.

Perils and hazards are related to the concept of risk.

Common examples of perils include fire, theft, illness, or death. Hazards (such as smoking or reckless behavior) increase the chance that a peril will occur, but they are not perils themselves.

When you apply for life or health insurance, the insurer looks at the hazards you may face and how those hazards relate to the peril being insured against. There are 3 types of hazards that insurers are concerned about:

Physical hazards include factors such as a person’s weight, medical history, and occupation. A moral hazard involves dishonesty - for example, an applicant who lies about medical history, occupation, or hobbies. Morale hazards are more subjective and include behaviors such as road rage or a tendency to drink alcohol to excess or use drugs, which can increase the risk of health problems or premature death.

Indifference can also be a morale hazard. For example, not locking a car because insurance will cover theft reflects a careless attitude that increases risk.

Insurance operates by pooling funds from many individuals facing similar risks to cover financial losses from specific events through contractual agreements. Key concepts in insurance are:

The Law of Large Numbers forms the statistical basis for insurance operations by enabling companies to predict claims with reasonable accuracy by pooling risks across a large group.

Insurable interest is needed for a person to benefit from insurance, with requirements including having a financial stake in the insured event.

Perils are the causes of losses, while hazards are factors promoting these losses, with insurers considering physical, moral, and morale hazards in assessing risks.

Insurance is essential for managing risk, but insurance companies rely on statistical principles and risk pooling to remain financially viable while paying covered claims.

Sign up for free to take 16 quiz questions on this topic