Restricted & control stock

There are rules that govern transactions in certain types of stock. This section focuses on Rule 144, which covers restricted stock and control stock.

Restricted stock

Restricted stock is stock that is not registered with securities regulators. You’ll learn more about the registration process later in the rules & regulations unit.

For now, keep two ideas in mind:

- Most securities offered publicly are legally required to go through a time- and cost-intensive registration process.

- Securities can sometimes be offered without registration if an exemption applies.

One example is Regulation D, which allows issuers to offer unregistered stock to private audiences made up primarily of wealthy and large investors.

When an investor obtains unregistered stock, they hold restricted stock. Rule 144 requires restricted stock to be held for 6 months before it can be resold. After that holding period, the investor can sell the shares.

Control stock

Control stock is stock held by an affiliate, meaning an insider of the company. An affiliate is any:

- officer,

- director, or

- 10% shareholder.

In other words, if you’re part of the issuer’s management or you own a large enough stake, you’re treated as an insider (an affiliate). Rule 144 regulates control stock to prevent insiders from selling large amounts of their shares too quickly.

This part of Rule 144 is often called the “dribble” rule. Insiders are frequently among the largest shareholders of their companies. Some CEOs own 51% or more of their companies so their vote controls the direction of the organization. If an insider tried to liquidate a large position all at once, it could put significant downward pressure on the stock price.

A 51% shareholder selling all of their shares in one trade is similar to a manufacturer dropping off 10,000 lawnmowers at a local Home Depot and asking for them to be sold immediately. Dropping the price close to zero might be the only way to get this accomplished.

To reduce this risk, affiliates (insiders) are subject to volume limitations. They’re allowed to sell the greater of:

- 1% of the outstanding shares, or

- the four-week trading average,

and they can do this four times a year. These volume limitations help prevent affiliates from selling significant amounts of shares in short periods of time.

You now know the definitions and rules for restricted stock and control stock. A common question is: what if an affiliate owns unregistered stock?

This happens often, especially when executives of privately held companies own stock in their company. In that case:

- Restricted stock rules apply because the stock is not registered with the SEC.

- Control stock rules apply because the shares are owned by an affiliate.

When both conditions are true, both sets of Rule 144 requirements apply at the same time.

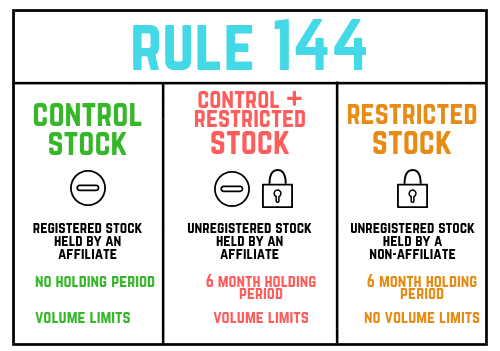

To summarize, here’s a visual representation of Rule 144:

Filings

Regulators aim to create a transparent environment in the securities markets. One way they do this is by requiring public filings of transaction reports related to Rule 144.

Form 144 must be filed when an investor (affiliate or non-affiliate) intends to trade control or restricted stock at any point in the next 90 days. This form is typically filed electronically on the Electronic Data Gathering, Analysis, and Retrieval (EDGAR) system.

A key detail: Form 144 is triggered by an intention to trade control or restricted stock. There is no requirement that a transaction actually occur.

The Securities and Exchange Commission (SEC), which oversees the filing process and maintains EDGAR, allows investors making small control or restricted stock transactions to avoid filing requirements. Specifically, Form 144 must be filed only if an investor plans to sell more than:

- 5,000 shares, or

- $50,000 of total stock.

Form 4 must be filed when an affiliate actually trades control stock. Form 4 reports beneficial changes in ownership for insiders and must be filed within two business days of the transaction.

Many financial media outlets pay close attention to these filings, especially when they involve well-known executives and investors. For example, this Form 4 filing was the reason why Elon Musk’s $6.9 billion sale of Tesla stock November 2021 was widely reported.

Rule 144A

One last item to cover is Rule 144A, which relates to Rule 144. If a sale of restricted or control stock occurs with a Qualified Institutional Buyer (QIB), the requirements of Rule 144 do not apply.

A QIB is defined as an institution with $100 million or more of investable assets. When a QIB is involved in the sale of control or restricted stock, the 6-month holding period and volume limitations do not apply.