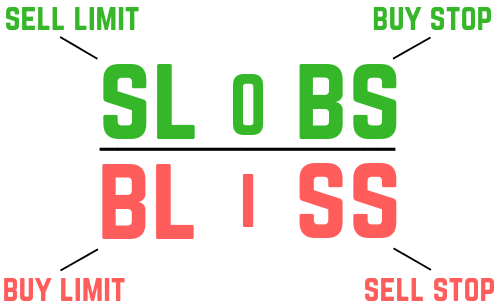

It’s important to know what the market price has to do for an order to trigger or execute. Many students use the acronyms SLOBS and BLISS to remember how common order types work. This visual is a useful one to memorize and re-write on your scratch paper during the SIE exam:

Using the visual, notice where each order type sits relative to the line:

Stop orders work differently: they don’t execute immediately. Instead, they trigger when the market reaches a specific price.

In case you were wondering, the “O” in SLOBS and the “I” in BLISS are only there to make the acronyms easier to say.

Another important detail is how certain orders are adjusted for cash dividends.

When a company pays a cash dividend, its stock price typically drops by the amount of the dividend on the ex-dividend date (the first day the stock trades without the dividend). The company is paying out cash (an asset), so the company is worth less than it was before the dividend.

Assume you place the following order:

Buy 100 shares of GE stock @ 15 limit

GE stock is trading at $15.50.

You want to buy 100 shares of GE, but only if the price is $15 or less. Since the stock is trading $0.50 higher, the order stays open (unexecuted).

Now suppose GE pays a $1 per share dividend. On the ex-dividend date, the stock price would be expected to fall from $15.50 to $14.50. Your order would execute because of the dividend-related price drop, not because of normal market buying and selling.

By default, broker-dealers adjust certain orders to help prevent this. Most investors who place orders “away” from the current market want the order to fill because of market forces, not simply because a dividend reduced the stock price.

Placing an order “away” from the market means placing an order that cannot currently be filled. For example, placing a sell 100 shares @ $30 stop when the market is at $31. The order cannot execute until the market price is $30 or below, therefore the order is “away” from the market

On the ex-dividend date, buy limits and sell stops (orders below the market) are adjusted downward by the amount of the dividend. For example:

Buy 100 shares of GE stock @ $15 limit

becomes

Buy 100 shares of GE stock @ $14 limit

After a $1 dividend, if GE is trading at $14.50, your order would not execute because the limit price has been adjusted to $14. The market price must now fall to $14 or below for the order to execute.

This adjustment happens for all buy limits and sell stops unless the order is marked “DNR” (Do Not Reduce). For example:

Buy 100 shares of GE stock @ $15 limit DNR

Even if GE pays a $1 dividend, this order would not be reduced. If the market price is $15.50, the $1 per share dividend would cause the order to be filled immediately on the ex-dividend date.

Sign up for free to take 4 quiz questions on this topic