Common stock investors are eligible for cash dividends paid by the stocks they own. Dividends are earnings (profits) passed on to stockholders, although no company is required to pay dividends. An organization’s business model ultimately determines if they pay dividends. Smaller, growing companies typically do not pay dividends, allowing profits to be retained and spent on scaling (growing) the business. Larger, well-established companies sometimes pay dividends as their business and profits are already sizeable.

Dividends are useful to investors because they provide a return on investment without selling stock. They are especially helpful to investors who need current income from their investments. For example, a retired individual seeking to replace their employment income with investment income. Let’s take a look at a real-world example of Target in 2022, which is a dividend-paying company:

March 10th - $0.90 per share dividend

June 10th - $0.90 per share dividend

September 10th - $1.08 per share dividend

December 10th - $1.08 per share dividend

An investor owning 10,000 shares of Target stock throughout 2022 received $39,600 in dividends. Investors seeking income can purchase shares in a dividend-paying company and collect those dividends over time.

A company’s Board of Directors (BOD) determines if and when a dividend is paid. If the BOD declares a dividend, the company makes a public announcement, which sounds something like this:

On January 13, 2022, Target Corporation announced that its Board of Directors declared a quarterly cash dividend of $0.68 per share of common stock. The dividend will be payable on March 10, 2022, to shareholders of record as of February 16, 2022.

There are a few important dates to remember here. First, the declaration date, which is the day the BOD publicly declares the dividend. In this example, the declaration date is January 13th. Remember, only the BOD can declare dividends, while stockholders maintain the right to receive dividends if declared.

Next, the record date is the day a stockholder must be officially “on the books” (the transfer agent’s book) as a shareholder. The record date is February 16th in our example. An investor must be a settled stockholder on the record date to receive the dividend. Keep in mind that stock has a one-business-day (T+1) settlement time frame.

The record date is directly related to the ex-dividend date. It’s not mentioned in dividend announcements, but it represents a critical cutoff point. The ex-dividend date (sometimes referred to as the ex-date) is the first day the stock trades without the dividend. Meaning, an investor buying the stock on the ex-date does not receive the dividend.

Try to focus on the word ‘ex.’ You can replace ‘ex’ with the word ‘without.’ Think about where else you see this word: ex-girlfriend, ex-husband, etc. If a person is your ex, you are now without them. The ex-dividend day can be translated to the “without the dividend” day.

A stock trade must settle on or before the record date for the investor to receive the dividend. The record date for Target’s dividend was Wednesday, February 16th. If an investor purchased Target stock on Tuesday, February 15th, they receive the dividend because the trade settles by the record date. Tuesday would be the trade date and the stock would settle on Wednesday, the first business day after the trade.

If an investor purchased Target stock regular-way on Wednesday, February 16th, the trade would settle on Thursday, February 17th. They don’t receive the dividend because they would not be a settled owner by the record date. Because Wednesday, February 16th is the first day an investor would buy the stock and not receive the dividend, February 16th is also the ex-dividend date.

Conversely, an investor that owned Target stock and sold their position on Wednesday, February 16th would keep the dividend. They wouldn’t be removed from the stockholder list until after the record date, and therefore is considered a settled owner on the record date. As you’ve probably noticed, settlement is the underlying concept for the ex-dividend date.

To summarize what occurs on the ex-dividend date:

Most of the time, the test will focus on the ex-dividend date with regular-way settlement. However, you might encounter a question regarding cash settlement trades, which settle the same day. Remember, all that is required to receive the dividend is to be a settled owner on the record date. If an investor performs a cash settlement trade on the record date, they’ll settle the same day and receive the dividend. Therefore, the ex-dividend date for a cash settlement transaction is the business day after the record date.

The last date worth mentioning is the payable date, which is precisely what it sounds like. It’s when the dividend payment is made to the stockholders. For the Target example, the payable date is March 10th.

Here is an overview of the example above:

| Date | Events |

|---|---|

Jan 13, 2022 Thursday | Declaration date |

Feb 15, 2022 Tuesday | Regular-way settlement Last day to buy w/ dividend |

Feb 16, 2022 Wednesday | Record date Regular-way settlement Ex-dividend date Trades w/o dividend Cash settlement Last day to buy w/ dividend |

Feb 17, 2022 Thursday | Cash settlement Ex-dividend date Trades w/o dividend |

Mar 10, 2022 Monday | Payable date |

The ex-dividend date is based on settlement, which is controlled by the New York Stock Exchange (NYSE) or FINRA. The NYSE controls settlement for securities trades occurring on the NYSE, while FINRA controls settlement for trades in the OTC market. Regardless, both currently maintain the same settlement timeframes (T+1 for regular way / same day for cash settlement).

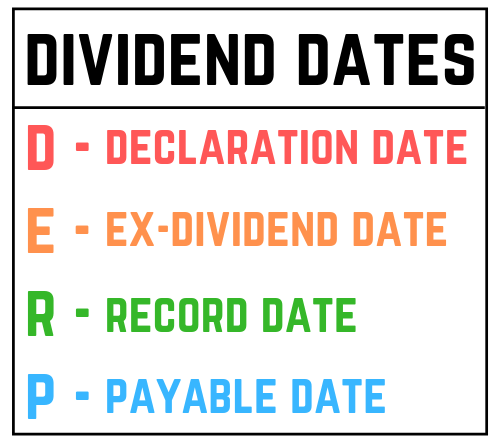

The acronym ‘DERP’ can help you remember the order of the dividend dates.

Here’s a video summarizing many of the key points above:

Sign up for free to take 13 quiz questions on this topic