Short puts

This chapter covers the fundamentals of short put options contracts. To get comfortable with the language used when discussing options, watch this video:

When an investor goes short a put, they are bullish on the underlying security’s market price. Selling a put obligates the investor to buy stock at the strike price if assigned (exercised).

- If the stock’s market price falls below the put’s strike price (think “put down” - the put is in the money), the holder may exercise the option. That forces the writer to buy shares at the strike price.

- If the market price rises above the strike price (the put is out of the money), the holder won’t exercise. The writer keeps the premium as their gain.

Let’s work through a few examples to understand short puts better:

Short 1 ABC Sep 75 put @ $6

This contract obligates the writer to buy ABC stock at $75 per share if assigned. The writer received $600 for selling the option ($6 premium x 100 shares). The option expires on the third Friday in September.

By selling this put, the investor is betting ABC stock’s market price stays at or above $75 through expiration. If the market price falls below $75, the holder may exercise the option, which can create losses for the writer.

Math-based options questions should be expected on the exam. Typically, they ask about potential gains, losses, and breakeven values. Let’s go through each.

An investor goes short 1 ABC Sep 75 put @ $6. The market price falls to $0. What is the gain or loss?

Can you figure it out?

Answer = $6,900 loss

| Action | Result |

|---|---|

| Sell put | +$600 |

| Assigned - bought shares | -$7,500 |

| Share value | +$0 |

| Total | -$6,900 |

At $0, the option is $75 in the money. This is the worst-case scenario for a put writer. We can assume the investor is assigned, requiring the purchase of 100 ABC shares at $75.

- The investor pays $7,500 for shares that are now worth $0.

- That’s a $7,500 loss from the stock purchase.

- The $600 premium received up front offsets part of that loss.

Overall loss: $7,500 − $600 = $6,900.

The maximum loss for a short put can be found by utilizing this formula:

The strike price of $75 minus the premium of $6 leaves the investor with a maximum loss of $69 per share (or $6,900 overall).

In the short call chapter, we learned an option is “naked” when sold without a hedge (protection). The same applies to a short put.

A short put is risky because it may force the investor to buy shares at the higher strike price when their market value is lower. In the worst-case scenario, the investor is forced to purchase worthless shares at the strike price.

In the next chapter, you’ll learn how investors protect themselves from risk on short options. For now, here is a quick list of investments that would cover a short put:

- Short shares

- Long put

- Cash (equal to the maximum loss)

The risk of a short put comes from buying shares at assignment and then being stuck with shares worth less than what was paid (or worth nothing). A hedge changes that risk:

- If the investor is short the shares, the sale already occurred. When the put is assigned, the investor effectively “buys back” the short shares, closing the short position. There’s no need to worry about selling later at a lower price because the shares were already sold short.

- If the investor owns a put (in addition to the short put), they have the right to sell the shares purchased at assignment at the long put’s strike price. Even if the market price drops sharply, they can exercise the long put and sell at the higher strike price.

- While cash does not prevent losses, posting cash equal to the maximum loss of a short put technically “covers” the put. The investor has enough funds to meet the obligation. Remember that cash cannot cover a short call because its risk is unlimited.

Let’s look at an example that is more likely to occur:

An investor goes short 1 ABC Sep 75 put @ $6. The market price falls to $60. What is the gain or loss?

Answer = $900 loss

| Action | Result |

|---|---|

| Sell put | +$600 |

| Assigned - bought shares | -$7,500 |

| Share value | +$6,000 |

| Total | -$900 |

At $60, the option is $15 in the money. After assignment, the writer must buy 100 ABC shares for $75.

- The investor pays $7,500 for shares worth $6,000.

- That’s a $1,500 loss from the stock purchase ($15 x 100).

- The $600 premium offsets part of the loss.

Overall loss: $1,500 − $600 = $900.

Investors who sell puts don’t always lose money. Even if ABC’s market price falls below $75, the writer must lose more than the premium to end up with an overall loss.

Let’s work through another example.

An investor goes short 1 ABC Sep 75 put @ $6. The market price falls to $69. What is the gain or loss?

Answer = $0 (breakeven)

| Action | Result |

|---|---|

| Sell put | +$600 |

| Assigned - bought shares | -$7,500 |

| Share value | +$6,900 |

| Total | $0 |

At $69, the option is $6 in the money. Assignment forces the investor to buy ABC stock at $75 when it’s worth $69.

- Loss from the stock purchase: $6 per share x 100 = $600

- Premium received: $600

The premium exactly offsets the assignment loss, so the investor breaks even.

When investing in puts, the breakeven can be found using this formula:

You probably noticed this is the same breakeven formula for long puts. The long and short positions are opposites, so they break even at the same stock price.

With a strike price of $75 and a premium of $6, the investor breaks even when ABC stock is at $69 per share. At this market value, there is no profit or loss.

The breakeven formula is also the same as a short put’s maximum loss formula (on a per-share basis). The difference is how you use it:

- Maximum loss is a dollar loss, so you multiply by 100 to get the per-contract amount.

- Breakeven is a stock price, so you don’t multiply by 100.

If ABC’s market price doesn’t fall too far below $75, the investor could still make a profit. For example:

An investor goes short 1 ABC Sep 75 put @ $6. The market price falls to $74. What is the gain or loss?

Answer = $500 gain

| Action | Result |

|---|---|

| Sell put | +$600 |

| Assigned - bought shares | -$7,500 |

| Share value | +$7,400 |

| Total | +$500 |

At $74, the option is $1 in the money. Assignment creates a $1 per share loss because the investor buys at $75 shares worth $74.

- Loss from the stock purchase: $1 x 100 = $100

- Premium received: $600

Overall gain: $600 − $100 = $500.

Expiration is the best-case scenario for investors writing (going short) options. If the option expires worthless, the investor keeps the premium and never has to fulfill the obligation. The same applies to short put contracts.

An investor goes short 1 ABC Sep 75 put @ $6. The market price rises to $84. What is the gain or loss?

Answer = $600 gain

| Action | Result |

|---|---|

| Sell put | +$600 |

| Total | +$600 |

At $84, the option is $9 out of the money and has no intrinsic value. When the market price is above $75, the holder won’t exercise. They wouldn’t choose to sell stock for $75 when it can be sold in the market for $84.

An easy way to think about assignment for puts is the phrase “put down.” Puts are exercised when the underlying security’s market price is below the strike price. That isn’t true here, so the option expires.

Investors with short options can only make the premium, nothing more. If exercise occurs, losses start eating away at the premium and can push the investor into an overall loss.

Writers can also perform closing transactions to exit their obligations before expiration.

An investor goes short 1 ABC Sep 75 put @ $6. After ABC’s market price rises to $79, the premium falls to $2, and the investor does a closing purchase. What is the gain or loss?

Answer = $400 gain

| Action | Result |

|---|---|

| Sell put | +$600 |

| Close put | -$200 |

| Total | +$400 |

To find the profit or loss for a closing transaction, compare:

- the premium received when selling the option, and

- the premium paid to buy it back.

Here, the investor sold the put for $6 and later bought it back for $2. That’s a $4 net gain per share.

Because option premiums represent 100 shares, the overall gain is $4 x 100 = $400.

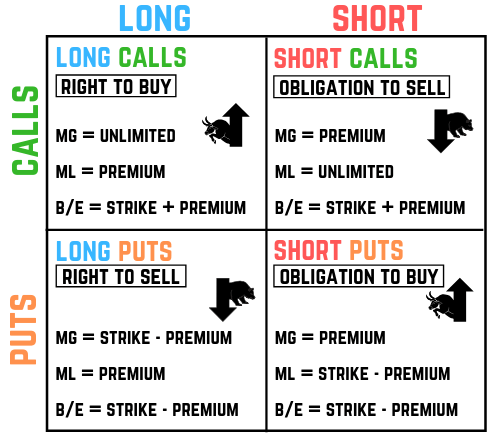

Here’s a visual summarizing the important aspects of short puts:

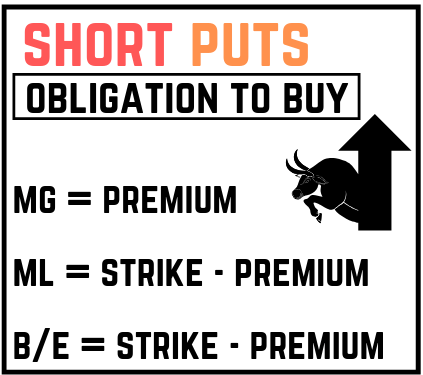

You’ve now been through all four versions of options: long calls, short calls, long puts, and short puts. The following visual puts it all together: