Investors use spreads for many reasons. Often, the type of spread reflects a bullish or bearish market view. You’ll see the intent behind these strategies in the next few chapters.

There are two broad categories of spreads:

Let’s look at an example of each.

An example of a call spread:

Long 1 ABC Jan 60 call

Short 1 ABC Jan 70 call

A call spread is created when an investor is long one call and short one call at the same time. The two options can have different strike prices, different expirations, or both. As long as you’re long a call and short a call simultaneously, it’s a call spread.

Next, an example of a put spread:

Long 1 ABC Mar 40 put

Short 1 ABC Jun 40 put

A put spread is created when an investor is long one put and short one put at the same time. Again, the two options can have different strike prices, different expirations, or both. As long as you’re long a put and short a put simultaneously, it’s a put spread.

The differences in strike prices and/or expirations across the two legs determine the spread’s classification. There are three spread classifications:

First, let’s start with a vertical (price) spread:

Long 1 ABC Jan 60 call

Short 1 ABC Jan 70 call

A vertical spread exists when the two contracts have different strike prices but the same expiration. Here, the strike prices differ ($60 and $70), and both options expire in January.

Vertical spreads are also called price spreads. That name fits because the “spread” (difference) is in the strike prices.

Next, let’s look at a horizontal (calendar/time) spread:

Long 1 ABC Mar 40 put

Short 1 ABC Jun 40 put

A horizontal spread exists when the two contracts have different expirations but the same strike price. Here, the expirations differ (March and June), and both options have a $40 strike.

Horizontal spreads are also known as time spreads or calendar spreads. Again, the “spread” (difference) is in the expirations.

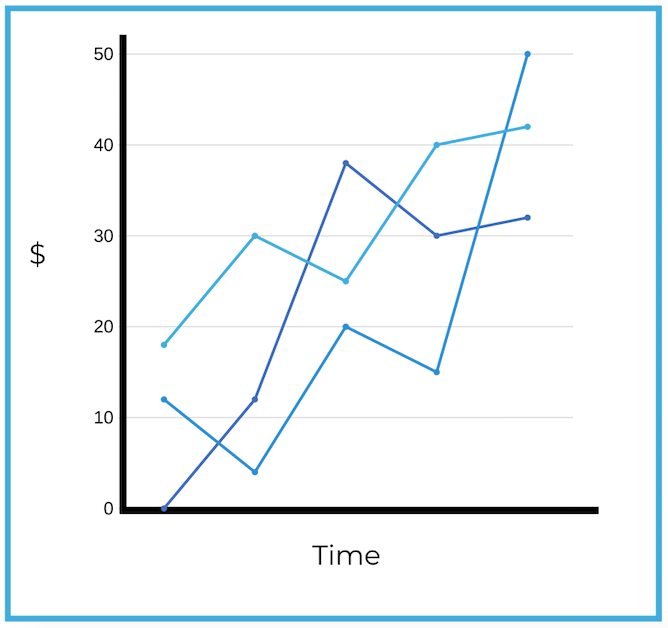

If you’re wondering why the terms vertical and horizontal are used, they come from how information is shown on a price chart:

Last, let’s look at a diagonal spread:

Long 1 ABC Sep 45 call

Short 1 ABC Nov 55 call

A diagonal spread exists when the two contracts have different expirations and different strike prices. Here, the expirations differ (September and November) and the strike prices differ ($45 and $55).

It is unlikely you’ll encounter any math-related test questions on diagonal spreads, but you may be asked to identify them.

Sign up for free to take 12 quiz questions on this topic