Investors must specify how a trade should be carried out when they place an order to buy or sell a security. This chapter covers four common order types:

Market orders are used when the main goal is speed. A market order doesn’t include a price. Instead, it executes at the next available market price. In practice, market orders often fill within seconds.

When you place a market order:

That lack of price control is especially important when the market is closed.

Assume an investor places a market order to buy stock in a pharmaceutical company after the market closes when the stock price is $50. A few hours later, a news article about the company curing cancer is published, and the stock price skyrockets to open at $200 the next day. If the investor’s order is still in place at the market open, they will pay 4x the amount they likely expected to pay. Although scenarios like this are relatively rare, it’s common for stock prices to fluctuate overnight.

It can also move against a seller. Using the same $50 stock, a customer who places a market order to sell after the close could wake up to a much lower opening price and end up selling far below what they expected. For this reason, investors generally avoid placing market orders overnight.

When an order is placed, customers must specify the time the order covers. Generally speaking, orders can be day orders or good-til-canceled (GTC).

Market orders are designed to execute immediately, so broker-dealers typically default them to day orders.

Here’s a video that dives further into market orders:

Limit orders are used when price control matters. Unlike market orders, limit orders guarantee that the trade will occur at a specific price or better. The trade-off is that execution is not guaranteed.

Let’s work through a few examples.

Buy 100 shares of ABC stock @ $50 limit

Trading tape: $51.03… $51.01… $49.99… $49.98… $50.01…

The investor wants to buy 100 shares of ABC stock but won’t pay more than $50 per share. The order can execute once the stock trades at $50 or lower.

The trading tape shows available prices for the security from left to right. The first price that meets the condition ($50 or lower) is $49.99, so the order fills at $49.99.

Investors use limit orders to seek better prices. For example, if the stock is currently $55, a customer could place a buy limit at $50. If the price falls and the order executes, they buy $5 cheaper per share. If the price never falls to $50 or lower, the order won’t execute.

Let’s see if you can answer a buy limit order question.

Buy 100 shares @ $75 limit

Trading tape: $75.02… $75.03… $74.97… $75.00… $75.01…

At what price does the order go through?

Answer = $74.97

Buy limit orders fill at the price specified or lower. $74.97 is the first price available that’s $75 or lower.

Here’s a video that dives further into buy limit orders:

Let’s look at a limit order from the sell side:

Sell 100 shares of XYZ stock @ $70

Trading tape: $69.95… $69.98… $69.99… $70.01… $69.99…

At what price does the order go through?

If a price is specified and nothing else is added, it’s assumed to be a limit order (even if the word “limit” isn’t written).

This is a sell limit order. The customer wants to sell 100 shares at $70 or higher. The order can execute once the stock trades at $70 or above. On the trading tape, the first price that meets that condition is $70.01, so the order fills at $70.01.

Let’s see if you can answer a sell limit order question.

Sell 100 shares @ $30

Trading tape: $30.05… $30.02… $29.99… $29.97… $30.01…

At what price does the order go through?

Answer = $30.05

Sell limit orders fill at the price specified or higher. $30.05 is the first price available that’s $30 or higher.

Here’s a video that dives further into sell limit orders:

Limit orders often take time to execute. Because of that, they can be placed as:

Stop orders, often called stop loss orders, can feel a bit “backward” at first:

Why buy higher or sell lower? Stop orders are commonly used to manage risk by automatically exiting a position once the market moves against you.

Let’s assume the following:

Long 100 shares of ABC stock @ $50

Investor places a sell 100 shares of ABC stock @ $45 stop

Sell stop orders trigger when the market price falls to the stop price or below. When the order triggers (also called electing), it begins the process of executing.

In this example, the order triggers when the market price falls to $45 or below. The investor is using the stop to limit losses to about $5 per share.

Long 100 shares of ABC stock @ $50

Investor places a sell 100 shares of ABC stock @ $45 stop

Trading tape: $45.02… $45.01… $44.99… $44.97… $45.01…

Stop orders use a two-step process:

Here, the order triggers at $44.99 (the first price at $45 or below). After triggering, it becomes a market order and executes at the next available price, $44.97.

Because a stop order turns into a market order after it triggers:

Let’s see if you understand sell stop orders.

An investor goes long 100 shares of stock @ $80. They place a sell 100 shares @ $78 stop order.

Trading tape: $79… $80… $78.50… $78… $79…

At what price will the order trigger? At what price will the order execute?

Trigger.= $78

Execute = $79

Sell stop orders trigger when the market price falls to or below the stop price. This order triggers at $78. After the trigger, the order executes at the next available price, which is $79.

Here’s a video that dives further into sell stop orders:

Buy stop orders are also “stop loss” orders, but for short stock positions. Click the following link if you need a refresher on shorting a security.

Investors with short positions use buy stops to limit losses if the stock price rises.

Sell short 100 shares of ABC stock @ $80

Investor places a buy 100 shares of ABC stock @ $90 stop

Buy stop orders elect (trigger) when the market price rises to the stop price or above. In this example, the order elects when the market price rises to $90 or above. The investor is using the stop to cap losses on the short position.

Sell short 100 shares of ABC stock @ $80

Investor places a buy 100 shares of ABC stock @ $90 stop

Trading tape: $89.97… $89.99… $90.02… $90.01… $89.98…

The order triggers at $90.02 (the first price at $90 or above). After triggering, it becomes a market order and executes at the next available price, $90.01.

Let’s see if you understand buy stop orders.

An investor goes short 100 shares of stock @ $20. They place a buy 100 shares @ $21 stop order.

Trading tape: $20.70… $20.90… $21. 10… $20.50… $20.85…

At what price will the order trigger? At what price will the order execute?

Trigger = $21.10

Execute = $20.50

Buy stop orders trigger when the market price rises to or above the stop price. This order triggers at $21.10. After the trigger, the order executes at the next available price, $20.50.

Here’s a video that dives further into buy stop orders:

Like limit orders, stop orders can be day or GTC orders. If placed as a day order, the order is canceled if it remains unexecuted by the end of the day. If placed as a GTC order, the order stays open until executed or canceled by the investor.

Stop limit orders combine features of stop orders and limit orders. A stop limit order is a stop order that becomes a limit order after it triggers (elects). The key difference from a regular stop order is what happens after the trigger:

Stop limit orders are used for the same general purpose as stop orders (often to limit losses), but they’re especially useful when the investor wants more control over the execution price.

Long 100 shares of ABC stock @ $30

Investor places a sell 100 shares of ABC stock @ $25 stop $23 limit

To approach a sell stop limit order, focus on the stop first:

Long 100 shares of ABC stock @ $30

Investor places a sell 100 shares of ABC stock @ $25 stop $23 limit

Trading tape: $25.03… $25.01… $24.99… $24.98… $24.95…

The order triggers at $24.99 (the first price at $25 or below). After triggering, it becomes a limit order and can execute as long as the market is $23 or higher. The next available price is $24.98, so the order executes there.

The limit portion protects the investor from selling below $23 per share.

Let’s see if you understand a sell stop limit.

An investor goes long 100 shares of stock @ $70. They place a sell 100 shares @ $65 stop limit order.

Trading tape: $65.10… $64.90… $64.95… $65.05… $64.85

At what price will the order trigger? At what price will the order execute?

Trigger = $64.90

Execute = $65.05

Sell stop limit orders trigger when the market price falls to or below the stop price. This order triggers at $64.90. After the trigger, the order executes when the market rises to $65 or higher. The order executes at $65.05.

In case you were wondering, both the stop and the limit price are the same when only one price is specified.

Here’s a video that dives further into sell stop limit orders:

Let’s take a look at a buy stop limit order:

Sell short 100 shares of ABC stock @ $70

Investor places a buy 100 shares of ABC stock @ $77 stop limit

Again, focus on the stop first:

Sell short 100 shares of ABC stock @ $70

Investor places a buy 100 shares of ABC stock @ $77 stop limit

Trading tape: $76.95… $76.99… $77.02… $77.01… $76.98…

The order triggers at $77.02 (the first price at $77 or above). After triggering, it becomes a limit order and can execute as long as the market is $77 or lower. The first available price that meets that condition is $76.98, so the order executes there.

The limit portion ensures the customer won’t buy above $77 per share.

Let’s see if you understand buy stop limit orders.

An investor goes short 100 shares of stock @ $25. They place a buy 100 shares @ $28 stop $29 limit order.

Trading tape: $27.97… $28.01… $28.09… $27.90… $27.50…

At what price will the order trigger? At what price will the order execute?

Trigger = $28.01

Execute = $28.09

Buy stop orders trigger when the market price rises to or above the stop price ($28). This order triggers at $28.01. After the trigger, the order executes if the market is at the limit price ($29) or below. The order executes at $28.09.

Here’s a video that dives further into buy stop limit orders:

Just like limits and stops, stop limit orders can be day or GTC. If placed as a day order, the order will be canceled if it doesn’t execute by the end of the day. If placed as a GTC order, the order will stay open until executed or canceled by the investor.

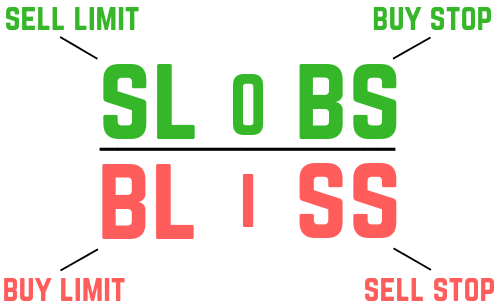

The key skill with order types is knowing what the market must do for an order to trigger or execute. Many people use “SLOBS” and “BLISS” to remember the direction of stops and limits. The following visual is useful to memorize and rewrite on your scratch paper during the Series 65 exam:

Using the visual:

Stop orders don’t execute immediately. They trigger at a specific market price:

In case you were wondering, the ‘O’ in “SLOBS” and the ‘I’ in “BLISS” are only there to make an acronym.

Sign up for free to take 22 quiz questions on this topic