Common stock investors may be eligible to receive cash dividends on the shares they own. A dividend is a portion of a company’s earnings that’s distributed to stockholders. Companies are not required to pay dividends, and some companies never do.

Whether a company pays dividends often depends on its business model and stage of growth:

Dividends matter to investors because they can provide a return without selling the stock. This can be especially important for investors who want ongoing income (for example, retirees).

Here’s a real-world example using Target in 2021, a dividend-paying company:

March 10th - $0.68 per share dividend

June 10th - $0.68 per share dividend

September 10th - $0.90 per share dividend

December 10th - $0.90 per share dividend

An investor owning 1,000 shares of Target stock throughout 2019 received $3,160 in dividends. Investors seeking income can buy shares of a dividend-paying company and collect dividends over time.

A company’s Board of Directors (BOD) decides whether a dividend will be paid. If the BOD declares a dividend, the company makes a public announcement that typically looks like this:

On January 14, 2021, Target Corporation announced that its Board of Directors declared a quarterly cash dividend of $0.68 per share of common stock. The dividend will be payable on March 10, 2021 to shareholders of record as of February 17, 2021.

There are a few key dates to pull from an announcement like this.

The declaration date is the day the BOD publicly declares the dividend. In this example, the declaration date is January 14th. Only the BOD can declare dividends, and stockholders only have the right to receive a dividend if it’s declared.

The record date is the day a stockholder must be “on the books” to receive the dividend. In this example, the record date is February 17th. To be “on the books,” you must be a settled owner of the stock by the record date. Keep in mind that stock has a one-business-day (T+1) settlement time frame.

That settlement rule leads to the ex-dividend date. You typically won’t see the ex-dividend date listed in the dividend announcement, but it’s a critical date. The ex-dividend date (often called the ex-date) is the first day the stock trades without the dividend. If you buy the stock on the ex-date, you do not receive the dividend.

It helps to focus on the word “ex.” You can think of “ex” as meaning “without” (ex-girlfriend, ex-husband, etc.). The ex-dividend date is the “without the dividend” date.

A stock trade must settle on or before the record date for the investor to receive the dividend. Target’s record date was Wednesday, February 17th.

Because Wednesday, February 17th is the first day an investor can buy the stock and not receive the dividend, it is the ex-dividend date.

Conversely, if an investor already owned Target stock and sold it on Wednesday, February 17th, they would keep the dividend. They wouldn’t be removed from the stockholder list (maintained by the transfer agent) until after the record date. Settlement is the key concept behind the ex-dividend date.

To summarize what occurs on the ex-dividend date:

Most of the time, the test will focus on the ex-dividend date with regular-way settlement. However, you may see a question involving cash settlement trades, which settle the same day.

Remember: to receive the dividend, you must be a settled owner on the record date.

The last important date is the payable date, which is when the dividend is actually paid to stockholders. In the Target example, the payable date is March 10th.

Here is an overview of the example above:

| Date | Events |

|---|---|

Jan 14, 2021 Thursday | Declaration date |

Feb 16, 2021 Tuesday | Regular-way settlement Last day to buy w/ dividend |

Feb 17, 2021 Wednesday | Record date Regular-way settlement Ex-dividend date Trades w/o dividend Cash settlement Last day to buy w/ dividend |

Feb 18, 2021 Thursday | Cash settlement Ex-dividend date Trades w/o dividend |

Mar 10, 2021 Monday | Payable date |

Three of these dates are set by the BOD:

The ex-dividend date is based on settlement rules, which are set by the New York Stock Exchange (NYSE) or FINRA.

Both follow the same settlement timeframes (T+1 for regular way / same day for cash settlement).

A dividend reinvestment plan (DRIP) is created by the actual issuer (TESLA, NVIDIA, XOM, etc ). It automatically reinvests dividends into additional shares instead of paying cash, often with no commission and sometimes at a discounted price. Reinvested dividends are taxable in the year received as ordinary income unless the company gives stock, then it’s taxable when sold.

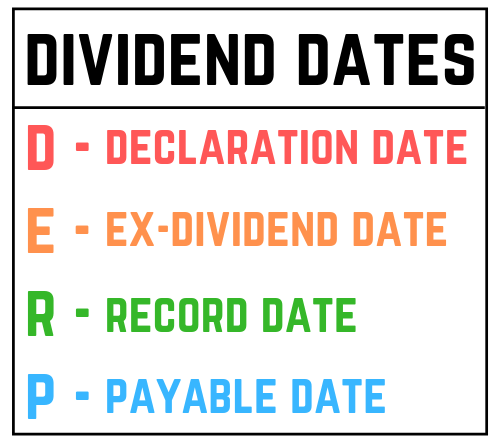

The exam may ask about the order of the dividend dates. A common memory aid is the acronym “DERP.”

Here’s a video summarizing many of the key points above:

Sign up for free to take 8 quiz questions on this topic