Restricted & control stock

Common stock can take many forms. Two important types you’ll see in this chapter are restricted stock and control stock. Both are regulated under Rule 144.

Restricted stock

Common stock is considered restricted when it isn’t registered with securities regulators.

You’ll learn more about the registration process later in the rules & regulations unit. For now, keep this basic idea in mind:

- Most securities offered to the public must go through a time- and cost-intensive registration process.

- In some cases, securities can be sold without registration if an exemption applies.

One common exemption is a private placement, which allows issuers to sell unregistered stock to a private audience made up primarily of wealthy investors.

When an investor acquires unregistered stock, they hold restricted stock. Under Rule 144, restricted stock must generally be held for six months before it can be resold. After that holding period, the investor may sell the shares.

Control stock

Stock held by an affiliate of the issuer is considered control stock. An affiliate is any:

- officer

- director

- 10% shareholder

For example, all Meta Platforms Inc. shares (ticker: META) held by Mark Zuckerberg are control stock.

Rule 144 regulates control stock to prevent insiders from selling large amounts of shares too quickly.

This part of Rule 144 is often called the dribble rule. Insiders are often among the largest shareholders of their companies. Some CEOs own 51% or more of their company to ensure they control voting decisions. If an insider tried to liquidate a large position all at once, it could put significant downward pressure on the stock price.

A helpful analogy is supply and demand: a 51% shareholder selling all their shares in one trade is like a manufacturer dropping off 10,000 lawnmowers at a local gardening store and asking the store to sell them immediately. Cutting the price close to zero might be the only way to move that much inventory that fast.

To reduce this risk, affiliates (insiders) are subject to volume limitations. They may sell the greater of:

- 1% of the outstanding shares, or

- the four-week trading average

They can do this four times a year. These limits help prevent affiliates from selling large numbers of shares over short periods.

When stock is both restricted and control stock

You now have the basic definitions and rules for restricted and control stock. A common question is: what if an affiliate owns unregistered stock?

This happens often, especially when executives of privately held companies own shares in their company.

In that case:

- Restricted stock rules apply because the stock isn’t registered with the SEC.

- Control stock rules apply because the shares are owned by an affiliate.

When both conditions are true, both sets of Rule 144 requirements apply at the same time.

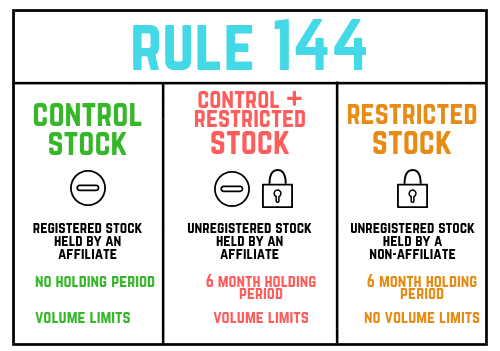

To summarize, here’s a visual representation of Rule 144:

Filings

Regulators aim to create transparency in the securities markets. One way they do this is by requiring public filings related to Rule 144 transactions.

Form 144 must be filed when an investor (affiliate or non-affiliate) intends to trade control or restricted stock at any point in the next 90 days. This form is typically filed electronically through the Electronic Data Gathering, Analysis, and Retrieval (EDGAR) system.

A key point: Form 144 is triggered by the intention to sell. The transaction doesn’t have to actually occur.

The Securities and Exchange Commission (SEC), which oversees EDGAR and the filing process, allows investors making small transactions to avoid this filing requirement. Specifically, Form 144 must be filed only if the investor plans to sell more than:

- 5,000 shares, or

- $50,000 of total stock

Form 4 must be filed when an affiliate actually trades control stock. Form 4 reports beneficial changes in ownership for insiders and must be filed within two business days of the transaction.

Financial media often watch these filings closely, especially when they involve well-known executives and investors. For example, this Form 4 filing was the reason Elon Musk’s $6.9 billion sale of Tesla stock November 2021 was widely reported.

Rule 144A

One last item to cover is Rule 144A, which is related to Rule 144. If restricted or control stock is sold to a Qualified Institutional Buyer (QIB), the requirements of Rule 144 do not apply.

A QIB is an institution with $100 million or more of investable assets. When a QIB is involved in the sale of control or restricted stock, the six-month holding period and volume limitations do not apply.