Primary market securities offered to the public are typically subject to registration requirements. As we discussed in a previous chapter, issuer transactions take place in the primary market. An issuer transaction occurs when the sales proceeds from a securities transaction are collected by the issuer.

Interstate* (more than one state) issuer transactions are subject to the Securities Act of 1933, the federal law that governs primary market offerings.

*Intrastate (within one state) issuer transactions are subject to the Uniform Securities Act (USA). We’ll learn more about the specifics later in this unit.

If you follow real-world securities markets, you may recognize the examples below. Each was an interstate initial public offering (IPO) and therefore subject to the Securities Act of 1933. An IPO is the first public primary market offering an issuer conducts.

In each of these IPOs, the issuers (Doordash, Airbnb, and Robinhood) had to follow specific protocols enforced by the Securities and Exchange Commission (SEC). We’ll cover those protocols in this chapter, but first it helps to understand why primary market laws exist.

The financial markets in the early 1900s included widespread fraud, deceit, and manipulation - problems that contributed to the Great Depression. Imagine being offered stock by a slick salesperson in the 1920s. How would you know whether the investment was worthwhile? How would you know whether the salesperson was lying - or whether the issuer even existed? This was long before the internet or television, so access to reliable information was limited.

Signed into law to protect the investing public, the Securities Act of 1933 requires issuers to fully disclose key information about the securities they intend to sell. To make sure potential investors can access that information, issuers and their underwriters must follow specific steps before and during the offering.

Underwriters are hired by issuers to help structure, market, and sell securities to the public. Investment banking (also called underwriting) can be a major business. For example, Facebook’s underwriters made over $100 million during their IPO in 2012. Underwriters can provide general advice, help set terms, and may also sell the securities. Real-world examples of underwriters include:

Issuers typically conduct an extensive search to find the right underwriter. After the parties agree and sign a contract, the underwriter guides the issuer through the due diligence phase.

The Securities Act of 1933 requires the issuer to disclose a significant amount of information to the public. The issuer completes and files the SEC’s registration form, which requests items such as business history, information on officers and directors, and current financial status. Specific items detailed in the registration form include:

Filing the registration form starts the 20-day “cooling off” period. During this time, the SEC reviews the filing for completeness. This review takes time, which is why the period is 20 days.

The SEC’s goal is to ensure the public has access to the required disclosures before any sales activity occurs. As a result, the underwriter (and any other financial firm connected to the IPO) cannot:

In other words, sales-related activity is off-limits during this 20-day period.

Some activities are allowed during the cooling-off period. The information in the SEC registration form is compiled into a document called the prospectus. Investors use the prospectus to learn about the issuer and the security.

During the 20-day cooling-off period, the registration materials are provided as a “preliminary” prospectus, which may be given to potential investors on a solicited or unsolicited basis.

The preliminary prospectus is sometimes called a “red herring.” It remains preliminary until the SEC declares the registration effective. The term “red herring” comes from a message printed in red on the preliminary prospectus:

A Registration Statement relating to these securities has been filed with the Securities and Exchange Commission but has not yet become effective. Information contained herein is subject to completion or amendment. These securities may not be sold nor may offers to buy be accepted prior to the time the Registration Statement becomes effective.

Here’s a link to Robinhood’s preliminary prospectus for their IPO in 2021. You’ll find similar language shaded in red if you scroll down below the “Calculation of Registration Fee” section.

In plain English, the preliminary prospectus hasn’t been finalized and may change. Also, it’s important to understand what the SEC does and does not do:

If the issuer misleads or lies in the registration statement, the issuer (and responsible individuals) may face significant fines and sanctions. Jail time is also possible for anyone who knowingly provides false information.

The SEC’s job is to determine whether the registration form is complete. If information is missing, the SEC sends a deficiency letter identifying what must be corrected. This pauses the registration process until the issuer updates the filing and re-files it with the SEC.

If you’re curious, you can read a real-world deficiency letter related to The We Company (the company that owns WeWork) by clicking here. The company’s attempt to register its securities for public sale is now known for many missteps. For more background, read this article or watch this documentary.

Part of the underwriter’s job is to price the new security. This can be especially challenging with stock, since its market value depends on demand. To estimate demand for the IPO, the underwriter may solicit or receive indications of interest from potential investors during the 20-day cooling-off period.

Indications are just that - indications. They are not binding on either party:

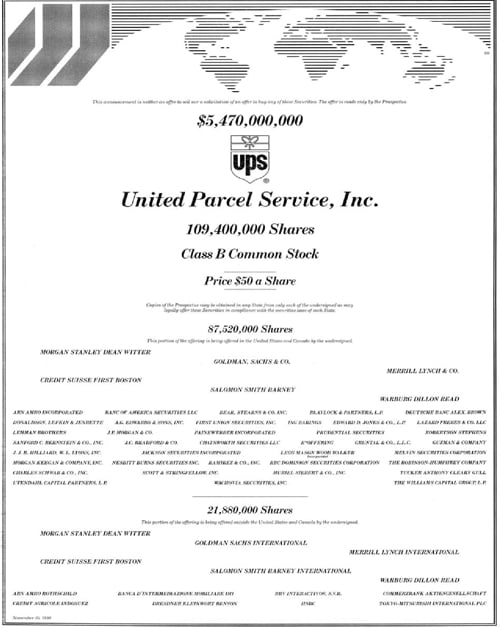

To notify the public of the new issue, a tombstone may be published. The term “tombstone” refers to the ad’s appearance (it resembles a tombstone).

Tombstones are typically published in newspapers and online outlets. They are the only form of legal advertising the SEC allows during the cooling-off period. A tombstone includes factual information and cannot “pump up” or recommend the issue.

Typical tombstone information

To summarize, here’s what can and cannot be done during the 20-day cooling-off period.

Legal during the 20-day cooling-off period

Distribute the preliminary prospectus

Take indications of interest

Publish a tombstone

Illegal during 20-day cooling-off period

Recommend the new issue

Advertise the new issue

Sell the new issue

Take a deposit for the new issue

After the SEC reviews a completed registration form, the SEC will register the security. At some point during the cooling-off period, an effective date is announced. The effective date is the first day the security may be legally sold to the public. As with registration rules for registered persons, issuers and/or underwriters may not claim the registration has been “approved.”

Once the registration is effective, the underwriter contacts customers who submitted indications of interest. If demand is high, the underwriter must decide which customers receive shares. There are few specific guidelines here, so underwriters often allocate shares to their most profitable customers.

New issues are sold at the public offering price (POP). You may remember this term from the Mutual funds chapter. Similar to buying a mutual fund, IPO purchases are made at the POP.

The Securities Act of 1933 requires the underwriting syndicate to deliver a prospectus to each customer buying the IPO. The prospectus contains the information filed in the registration statement, plus the POP. The prospectus must be delivered in its original, unaltered form - firms cannot highlight, summarize, or modify it.

After the issue is sold in the primary market, investors trade it in the secondary market.

Sign up for free to take 7 quiz questions on this topic