As we discussed previously, issuers hire underwriters to sell their securities to investors. The issuer and the underwriter sign a contract that lays out:

After the contract is signed, the underwriter guides the issuer through the due diligence phase. The Securities Act of 1933 requires the issuer to disclose a significant amount of information to the public. To do that, the issuer completes and files the SEC’s registration form, which asks for items such as business history, information on officers and directors, and current financial status.

Filing the registration form starts the 20-day “cooling off” period. During this time, the SEC reviews the filing to confirm it’s complete. This review takes time, which is why the period is set at 20 days.

The SEC’s goal is to make sure the public has access to the required disclosures before any sales activity begins. As a result, the underwriter (and any other financial firm connected to the IPO) cannot:

In other words, sales-related activity is off limits during this 20-day period.

Some activities are allowed during the cooling off period. The information in the SEC registration form is compiled into a document called the prospectus. Investors use the prospectus to learn about the issuer and the security.

During the 20-day cooling off period, the registration form is used to create a “preliminary” prospectus, which can be given to potential investors on a solicited or unsolicited basis.

Sometimes called the “red herring,” this prospectus is considered preliminary until the SEC officially registers the security. The term ‘red herring’ comes from a message printed in red on the preliminary prospectus:

A Registration Statement relating to these securities has been filed with the Securities and Exchange Commission but has not yet become effective. Information contained herein is subject to completion or amendment. These securities may not be sold nor may offers to buy be accepted prior to the time the Registration Statement becomes effective.

In plain English, the preliminary prospectus may be incomplete and can change.

It’s also important to understand what the SEC does not do here. The SEC does not verify the registration form for accuracy, and it does not guarantee anything about the new issue. If the issuer misleads or lies on the registration form, the issuer (and the individuals involved) can face significant fines and sanctions. Jail time is also possible for anyone who knowingly lies while completing the form.

The SEC’s job is to determine whether the registration form is complete. If something is missing, the SEC sends a deficiency letter to the issuer identifying what needs to be added. This pauses the registration process until the missing information is submitted. The issuer must complete the filing and re-file it with the SEC, which takes additional time.

Part of the underwriter’s job is to price the new security. This is especially challenging with stock, since its market value depends heavily on demand. To estimate demand for the IPO, the underwriter may solicit or receive indications of interest from potential investors during the 20-day cooling off period.

Indications are just that - indications - and they aren’t binding on anyone:

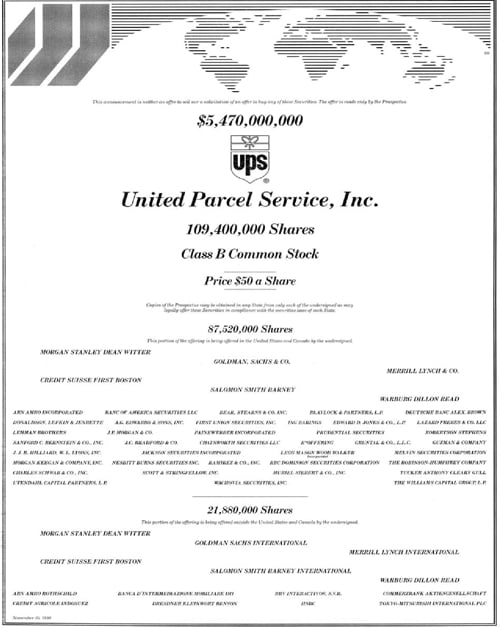

To notify the public that a new issue is coming, a tombstone may be published. The term “tombstone” refers to the ad’s appearance (it resembles a tombstone).

Tombstones are typically published in newspapers and online outlets. They’re the only form of legal advertising the SEC allows during the cooling off period. A tombstone includes factual information and avoids language that would “pump up” or recommend the issue.

Typical tombstone information

To summarize, here’s what can and cannot be done during the 20-day cooling off period.

Legal during 20-day cooling off period

Distribute the preliminary prospectus

Take indications of interest

Publish a tombstone

Illegal during 20-day cooling off period

Recommend the new issue

Advertise the new issue

Sell the new issue

Take a deposit for the new issue

Sign up for free to take 22 quiz questions on this topic