There are rules that govern transactions in certain types of stock. This section focuses on Rule 144, which covers restricted stock and control stock.

Restricted stock is stock that is not registered with the Securities and Exchange Commission (SEC). Most common stock is non-exempt and must be properly registered before it can trade freely in public markets. Because unregistered stock doesn’t provide the same level of disclosure about the security and the issuer, the SEC limits how it can be resold.

Restricted stock can be obtained in several ways, but private placements are the most common. Regulation D allows issuers to sell unregistered stock to private audiences, as long as the offering doesn’t exceed 35 non-accredited investors. Investors who buy in a private placement receive restricted (unregistered) stock.

Rule 144 requires restricted stock to be held for 6 months before it can be resold. After the holding period, the investor can sell the shares.

Control stock is stock held by an affiliate, meaning an insider of the company. An affiliate is any officer, director, or 10% shareholder. In other words, if you’re part of the issuer’s management or you own a large enough stake, you’re treated as an insider (affiliate).

Rule 144 regulates control stock to prevent insiders from selling large amounts of their shares too quickly.

This part of Rule 144 is often called the “dribble” rule. Insiders are often among the largest shareholders of their companies. Some CEOs own 51% or more of their companies so their vote controls the direction of the organization. If an insider tried to liquidate a large position all at once, it could put significant downward pressure on the stock price.

A 51% shareholder selling all their shares in one trade is similar to a manufacturer dropping off 10,000 lawnmowers at a local Home Depot and asking for them to be sold immediately. Dropping the price close to zero might be the only way to get this accomplished.

To reduce this risk, affiliates (insiders) are subject to volume limitations. They’re allowed to sell the greater of:

up to four times per year. These limits help prevent affiliates from selling significant amounts of shares in short periods of time.

You now know the definitions and rules for restricted and control stock. A common question is: what if an affiliate owns unregistered stock? This happens often, especially when executives of privately held companies own stock in their company.

In that situation:

When both conditions are true, both sets of Rule 144 requirements apply at the same time.

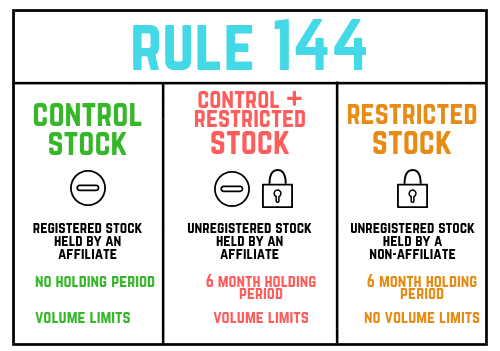

To summarize, here’s a visual representation of Rule 144:

Regulators aim to create a transparent securities market. One way they do this is by requiring public filings related to certain Rule 144 transactions.

Form 144 must be filed when an investor (affiliate or non-affiliate) intends to trade control or restricted stock at any point in the next 90 days. This form is typically filed electronically through the Electronic Data Gathering, Analysis, and Retrieval (EDGAR) system.

A key point: Form 144 is triggered by the intention to sell. There’s no requirement that a transaction actually occurs.

The SEC (which oversees the filing process and maintains EDGAR) allows investors making small control or restricted stock sales to avoid the filing requirement. Specifically, Form 144 must be filed only if the investor plans to sell more than:

Form 4 must be filed when an affiliate actually trades control stock. Form 4 reports beneficial changes in ownership for insiders and must be filed within two business days of the transaction.

Financial media often watch these filings closely, especially when they involve well-known executives and investors. For example, this Form 4 filing was the reason why Elon Musk’s $6.9 billion sale of Tesla stock November 2021 was widely reported.

One last item to cover is Rule 144A, which is related to Rule 144. If restricted or control stock is sold to a Qualified Institutional Buyer (QIB), the requirements of Rule 144 do not apply.

A QIB is an institution with $100 million or more of investable assets. When a QIB is involved in the sale of control or restricted stock, the 6 month holding period and volume limitations do not apply.

Sign up for free to take 16 quiz questions on this topic