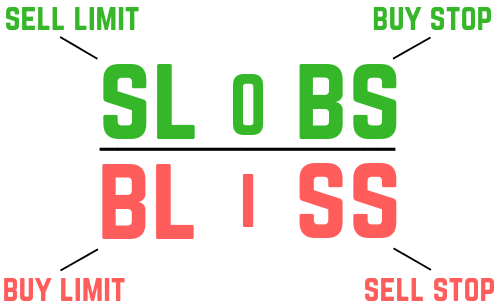

In conclusion, you need to know what the market price must do for an order to trigger or execute. Many students use the acronyms SLOBS and BLISS to remember how the main order types work. The visual below is a helpful one to memorize and rewrite on your scratch paper during the Series 7 exam.

Using this visual, you can quickly recall where each order sits relative to the current market price:

Stop orders don’t execute immediately. Instead, they trigger when the market reaches a specified price. Using the SLOBS/BLISS visual:

In case you were wondering, the “O” in SLOBS and the “I” in BLISS are only there to make the acronyms.

Another important detail is how certain orders are adjusted for cash dividends.

When a company pays a cash dividend, its stock price typically drops by the amount of the dividend on the ex-dividend date (the day the stock begins trading without the dividend). The company is paying out cash (an asset), so the company is worth less than it was before the dividend.

Assume you place the following order:

Buy 100 shares of GE stock @ 15 limit

GE stock is trading at $15.50.

You want to buy 100 shares of GE, but only if the price is $15 or less. Since the stock is trading $0.50 higher, the order stays open (unexecuted).

Now assume GE pays a $1 per share dividend. On the ex-dividend date, the stock price would be expected to fall from $15.50 to $14.50. Your order would execute because of the dividend-related price drop, not because of normal market movement.

By default, broker-dealers adjust certain orders to help prevent this. Specifically, they adjust orders placed below the market (buy limits and sell stops - see SLOBS/BLISS above). The idea is that most investors placing orders “away” from the current market want the order to fill due to market forces, not simply because a dividend reduced the stock price.

Placing an order “away” from the market means placing an order that cannot currently be filled. For example, placing a sell 100 shares @ $30 stop when the market is at $31. The order cannot execute until the market price is $30 or below, so the order is “away” from the market.

On the ex-dividend date, buy limits and sell stops (orders below the market) are adjusted downward by the amount of the dividend. For example:

Buy 100 shares of GE stock @ $15 limit

becomes

Buy 100 shares of GE stock @ $14 limit

So if GE falls to $14.50 after a $1 dividend, your order would not execute due to the adjustment. The market price would now have to fall to $14 or below for the order to execute.

This adjustment applies to all buy limits and sell stops unless the order includes DNR (Do Not Reduce). For example:

Buy 100 shares of GE stock @ $15 limit DNR

Even if GE pays a $1 dividend, this order would not be reduced. With the stock at $15.50, the $1 per share dividend would drop the price to $14.50 on the ex-dividend date, which would cause the order to be filled immediately.

Sign up for free to take 4 quiz questions on this topic