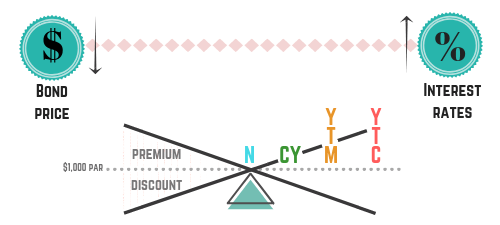

Here’s a summary of the discount bond example from the previous sections.

A 10 year, $1,000 par, 4% bond is trading at $800. The bond is callable at par after 5 years.

Coupon = 4%

Current yield = 5%

YTM = 6.7%

YTC = 8.9%

This order isn’t random. Every discount bond shows the same general relationship among these yields:

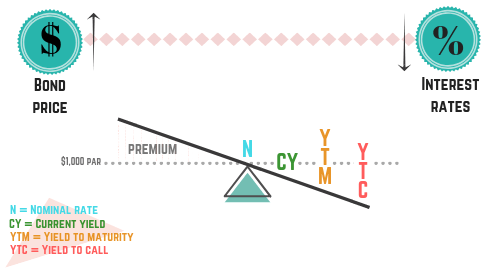

You can calculate each yield, but on exams it’s often more useful to recognize the relationship quickly. A common visual for this is the bond see-saw.

The bond see-saw helps you quickly connect a bond’s price (discount vs. premium) to the relative level of its yields. Many test-takers memorize the see-saw and rewrite it on scratch paper at the start of the exam to avoid doing unnecessary calculations.

NASAA tends to emphasize whether a yield is higher or lower than another yield more than your ability to compute every yield from scratch. You may still be asked to calculate current yield, but the order of yields is a higher-priority concept. Knowing that order also helps you eliminate incorrect answer choices on yield questions.

Now let’s use the premium bond example from the previous sections.

A 10 year, $1,000 par, 4% bond is trading at $1,100. The bond is callable at par after 5 years.

Coupon = 4%

Current yield = 3.6%

YTM = 2.9%

YTC = 1.9%

Again, this ordering follows a consistent pattern. Every premium bond shows the same general relationship among these yields:

You can use the bond see-saw here as well.

Just like with discount bonds, the see-saw gives you a quick visual. For a premium bond, the price side points upward because the bond is trading above par. If you remember the yield order shown on the see-saw, yield-based questions become much more straightforward.

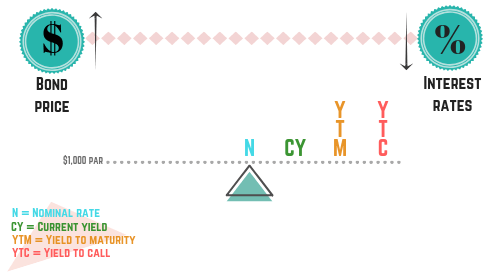

We’ve seen how price affects yields for bonds purchased at a discount and at a premium. What happens if a bond is purchased at par ($1,000)?

This case is simple: when a bond is purchased at par, all yields are equal to the coupon.

There’s no gain or loss from the purchase price:

So the investor’s return comes only from the coupon payments. For a bond purchased at par, the see-saw looks like this:

Here, the coupon lines up with current yield, YTM, and YTC. If you see a question about par bond yields, keep it simple: they’re all the same.

Yield is a major topic on the Series 65 exam, and the bond see-saw is a useful way to visualize the relationship between:

We’ve looked at the see-saw for discount, premium, and par bonds. Here they are together:

If you plan to use a “dump sheet,” this is a common item to include. A dump sheet is a set of key visuals or reminders you write on scratch paper after the exam begins. Many test-takers memorize the bond see-saw so they can recreate it quickly and use it to answer yield questions.

Some test-takers also use acronyms, like this:

CYM Call

CY = Current Yield

M = yield to Maturity

Call = yield to Call

Use whatever memory tool helps you recall these terms and their order.

Sign up for free to take 7 quiz questions on this topic