Wrapping up

You’ve reached the end of the Series 6 Achievable material.

This final chapter doesn’t introduce new testable content. Instead, it covers what to expect on exam day and a few practical best practices as your test date approaches.

When am I ready for the exam?

There’s no single perfect answer, but Achievable’s exam readiness score is your best overall gauge. At the top of your homepage, you’ll see a 0-100% score that reflects your likelihood of passing. In general, the closer your score is to 100%, the more likely you are to pass on test day.

Your score is based on multiple factors, including:

- Program completion (for example, reading chapters)

- Practice quiz performance

If you’ve used the program as intended, you’ve likely answered hundreds (or even thousands) of practice questions. Completing practice quizzes and assigned reviews is a key part of building the knowledge you’ll need for the exam.

One of the most important inputs to your readiness score is practice exam performance, including both your scores and the number of attempts. Practice exams help you “put the big picture together” by pulling questions from across all chapters in a format similar to the real test. One of the most effective ways to raise your readiness score is to take additional practice exams and improve your scores over time.

Before you take a practice exam, put your notes aside. Using outside resources (for example, the Achievable text or Google) will artificially inflate your score. On the actual exam, you won’t have access to study materials - only a notepad and a calculator.

After every practice exam, do a thorough review of each question and answer. Make sure you understand why you got each question right or wrong. Also, think beyond the question. A common pitfall is studying the questions instead of the underlying content. Our questions are designed to resemble the real exam, but no one knows exactly which questions will appear. FINRA closely guards its question bank, and its test writers use unique wording.

If you’re memorizing answers without understanding the why, you’re likely to struggle when the scenario or wording changes.

A useful self-check is:

“If I was given another question, with a completely different scenario and wording, am I confident I would know the answer?”

- If yes, keep moving forward.

- If no, go back and review that topic in the reading materials.

How many practice exams should I take?

There’s no uniform answer. Some people pass without taking a single practice exam, and others can fail after taking many. It depends on how well you understand and retain the material.

Generally, we recommend taking at least 10 practice exams. Many students start out scoring in the 50s or 60s. The goal is to build knowledge from each exam through careful review and then apply that learning on the next attempt.

A consistent passing score (70% or higher) over five or more exams usually indicates a solid grasp of the material. Higher is better.

Be sure to spend quality time reviewing each exam right after you take it. That review is where most of the improvement happens.

Another reason to take several practice finals is topic coverage. The Series 6 can test you across thousands of subtopics. A full-length practice exam covers only 50 questions - so the more exams you take, the more breadth you’ll see.

What score should I aim for on my practice exams?

A passing score (70% or above) is a good baseline. However, it’s smart to aim higher.

If you’ve averaged around 70% on your last several practice exams, you have a good chance of passing. Still, the real exam environment is different. Many test takers feel more anxious on exam day, and anxiety can negatively affect performance.

A practical target is a mid-to-high 70s average (or higher) on your last 2-3 practice finals. That gives you a buffer for test-day nerves or other issues.

Exam registration

1. You must be sponsored by a FINRA-member firm to take the Series 6 exam. This means you need to be employed by or affiliated with a firm that is a FINRA member.

2. Your sponsoring firm will need to file Form U4 (Uniform Application for Securities Industry Registration or Transfer) on your behalf. This form is submitted to FINRA and contains your personal, professional, and background information. Once submitted, you will be authorized to take the Series 6 exam.

3. You’ll schedule the Series 6 exam through FINRA’s Test Enrollment System (TES) or Prometric (the test administrator).

Additional exam information

The FINRA Series 6 exam costs $75 per attempt. The passing score is a 70% or higher.

There are waiting periods after failed attempts: 30 days after the first two failed attempts, and 180 days after the third and subsequent failures.

Tips for testing day

As you approach test day, the steps below can help the day go smoothly:

-

Review your email confirmation.

Check your appointment details either the night before your exam or the morning of it. Give yourself enough time to confirm the location, time, and any instructions.

-

Bring your ID.

Regardless of how you are testing, bring one valid, government-issued identification document with a signature and picture, such as an unexpired driver’s license, passport, or military ID. Also, make sure the name on your ID exactly matches the name under which your exam is scheduled.

-

Arrive early.

Arriving early helps you avoid last-minute delays and ensures you can check in on time.

Additional resources

As always, refer to the FINRA website for further information.

Check out the Achievable Blog for more study tips and best practices.

Dump sheet

Many test takers use “dump sheets” as study supplements and as a way to create a legal reference during the exam. A dump sheet typically includes visual guides and condensed notes on key topics. The idea is to memorize the material ahead of time and then “dump” it onto your notepad at the beginning of the exam.

These are allowed in the test center as long as they are created after the test has started (and not during the initial tutorial). They aren’t required to succeed, but some test takers find them helpful.

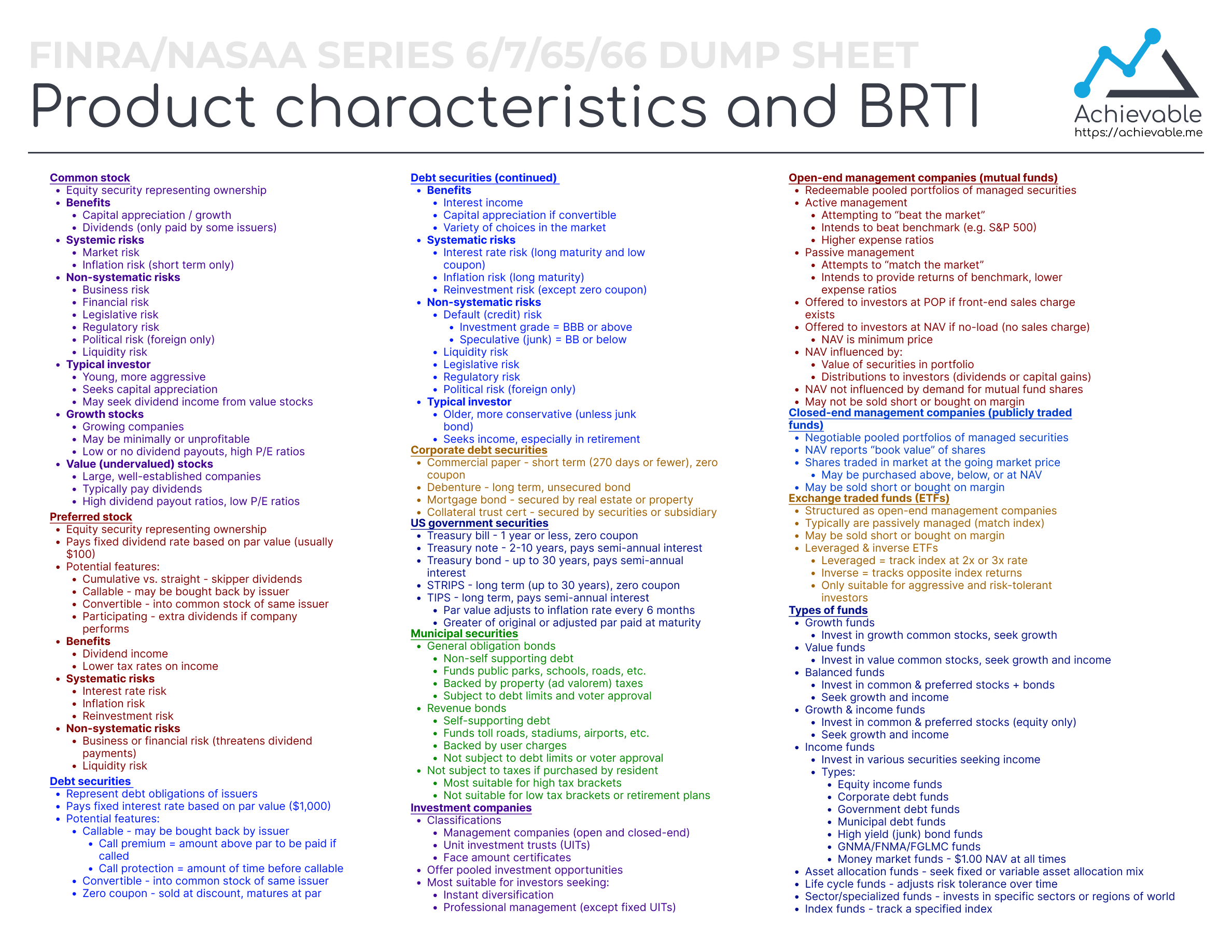

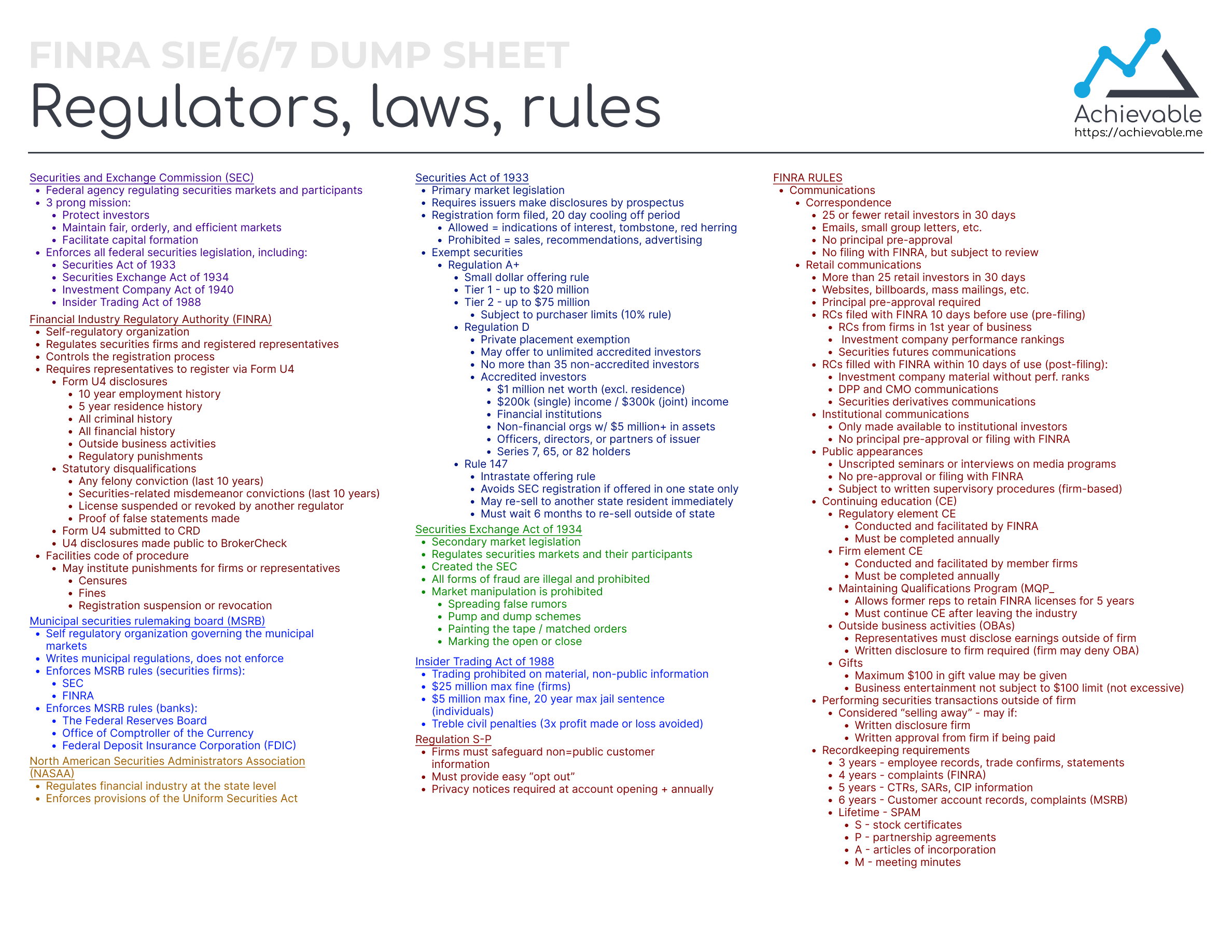

You can certainly create your own, but here are Achievable’s Series 6 dump sheets:

Download: Series 6 Dump Sheet - Product Characteristics and BRTI

Download: Series 6 Dump Sheet - Regulators, laws, rules

Final thoughts

FINRA exams can feel stressful, so it helps to plan for the parts you can control. Use the Achievable system as intended, take practice exams under realistic conditions, and review your results carefully.

If you have any feedback, please let us know!

Wishing you the best,

The Achievable team