This chapter covers the fundamentals of long call options contracts. To get comfortable with the language used when discussing options, watch this video:

When an investor goes long a call, they are bullish on the underlying security’s market price. Buying a call gives the holder the right (but not the obligation) to buy the stock at the strike price.

Let’s work through a few examples to understand long calls better:

Long 1 ABC Sep 75 call @ $6

This contract gives the right to buy ABC stock at $75 per share. The option costs $600 (because options typically cover 100 shares) and expires on the third Friday in September. The investor is expecting ABC’s market price to rise above $75 before expiration. If it doesn’t, the option expires and the investor loses the $600 premium.

Math-based options questions should be expected on the exam. Typically, they focus on potential gains, losses, and breakeven values. Let’s go through each.

A long call’s maximum gain is unlimited. The contract above allows the holder to buy 100 ABC shares at $75 any time before expiration. If the market price rises, the holder can exercise, buy at $75, and then sell at the higher market price. The higher the market price goes, the larger the potential profit.

For the following examples, assume the investor sells their shares immediately after exercising.

An investor goes long 1 ABC Sep 75 call @ $6. The market price rises to $100. What is the gain or loss?

Can you figure it out?

Answer = $1,900 gain

| Action | Result |

|---|---|

| Buy call | -$600 |

| Exercise - buy shares | -$7,500 |

| Sell shares | +$10,000 |

| Total | +$1,900 |

At a $100 market price, the call is $25 in the money ($100 − $75). The investor exercises, buys 100 shares for $7,500, and sells them for $10,000, creating a $2,500 gain from the stock transaction. After subtracting the $600 premium paid, the net result is a $1,900 gain.

While the maximum gain is unlimited, long calls don’t always end in a profit. Even if ABC’s market price rises above $75, the investor still has to earn back the premium.

Let’s try another example with the same option:

An investor goes long 1 ABC Sep 75 call @ $6. The market price rises to $81. What is the gain or loss?

Answer = $0 (breakeven)

| Action | Result |

|---|---|

| Buy call | -$600 |

| Exercise - buy shares | -$7,500 |

| Sell shares | +$8,100 |

| Total | $0 |

At $81, the call is $6 in the money ($81 − $75). Exercising produces a $600 gain on the shares (buy 100 at $75, sell 100 at $81). That $600 gain is exactly offset by the $600 premium paid, so the investor breaks even.

When investing in calls, the breakeven can be found using this formula:

With a strike price of $75 and a premium of $6, the investor breaks even when ABC stock is at $81 per share. At this market value, there is no profit or loss.

If ABC’s market price doesn’t rise far enough above $75, the investor can still have a loss even though the option is in the money. For example:

An investor goes long 1 ABC Sep 75 call @ $6. The market price rises to $79. What is the gain or loss?

Answer = $200 loss

| Action | Result |

|---|---|

| Buy call | -$600 |

| Exercise - buy shares | -$7,500 |

| Sell shares | +$7,900 |

| Total | -$200 |

At $79, the call is $4 in the money ($79 − $75). Exercising creates a $400 gain on the shares, but the $600 premium is larger than that gain, so the net result is a $200 loss.

Expiration is the worst-case scenario for investors holding long options. If the option expires worthless, the investor loses the entire premium. The same applies to long call contracts.

An investor goes long 1 ABC Sep 75 call @ $6. The market price falls to $73. What is the gain or loss?

Answer = $600 loss

| Action | Result |

|---|---|

| Buy call | -$600 |

| Total | -$600 |

At $73, the call is out of the money because the market price is below the $75 strike price. Exercising would mean paying $75 for stock that can be bought in the market for $73, so the investor lets the option expire. The loss is the $600 premium (the maximum possible loss).

Long options can only lose the amount spent on the premium. If exercising would create a loss, the investor will let the option expire.

Investors can also perform closing transactions to close their options before expiration.

An investor goes long 1 ABC Sep 75 call @ $6. After ABC’s market price rises to $79, the premium rises to $9, and the investor performs a closing sale. What is the gain or loss?

Answer = $300 gain

| Action | Result |

|---|---|

| Buy call | -$600 |

| Close call | +$900 |

| Total | +$300 |

The market price increased, and the option premium increased as well. Unlike the strike price, the premium is not fixed; it changes over time.

Here, the investor bought the call for $6 and later sold it for $9. That’s a $3 gain per share. Since one options contract typically represents 100 shares, the total gain is $300. For closing transactions, compare the premium paid to the premium received.

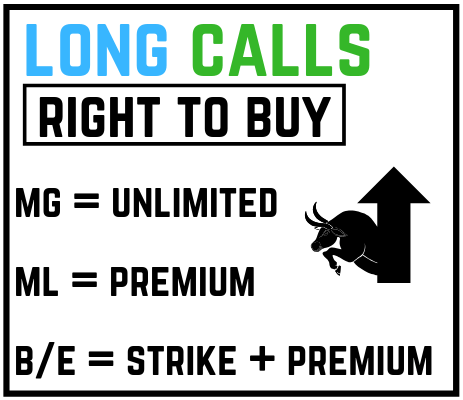

Here’s a visual summarizing the important aspects of long calls:

Sign up for free to take 11 quiz questions on this topic