When you can’t confidently predict whether the market will go up or down, but you do expect volatility, a long straddle can be an appropriate strategy. It can profit if the stock price moves significantly in either direction.

These are the components of a long straddle:

Long call & long put*

*Must be the same strike price and expiration

For example:

Long 1 ABC Jan 60 call

Long 1 ABC Jan 60 put

As you already know, a long call contract provides the “right to buy,” while a long put contract provides the “right to sell.” The long call is bullish (it benefits from rising prices). The long put is bearish (it benefits from falling prices). When an investor buys both, they’re betting on a big move - not on a specific direction.

If the stock’s market price rises above the call’s strike price (“call up”), the investor can exercise the call and potentially profit. The investor buys shares at the strike price and could sell them at the higher market price. The investor profits if the gain is greater than the combined premiums paid for both options.

If the stock’s market price falls below the put’s strike price (“put down”), the investor can exercise the put and potentially profit. The investor buys shares at the lower market price and sells them at the higher strike price. The investor profits if the gain is greater than the combined premiums paid for both options.

A long straddle can make money in either a bull or bear market, but it has an important cost: you pay two premiums. That means the stock has to move far enough for the intrinsic value of the in-the-money option to exceed the total premiums. If the stock stays near the shared strike price, the investor can lose up to the combined premiums.

Let’s walk through several scenarios to see how a long straddle behaves.

An investor goes long 1 ABC Jan 60 call at $4 and long 1 ABC Jan 60 put at $5 when ABC’s market price is $60. What is the gain or loss if ABC’s market price rises to $100?

Can you figure it out?

Answer = $3,100 gain

| Action | Result |

|---|---|

| Buy call | -$400 |

| Buy put | -$500 |

| Exercise call - buy shares | -$6,000 |

| Sell shares | +$10,000 |

| Total | +$3,100 |

At $100, the call is “in the money” (has intrinsic value), and the put is “out of the money” (no intrinsic value). The put expires worthless, but the call is exercised, allowing a purchase of ABC shares at $60. The shares are then sold at $100, creating a $40 gain per share, or $4,000 total ($40 x 100 shares). The $900 combined premium paid upfront reduces the gain to $3,100.

Only one option finished in the money, but the move was large enough that the call’s intrinsic value more than offset the $900 total premium.

The maximum gain for a long straddle is unlimited*. The further the market rises, the more intrinsic value the call option gains.

What happens if the market rises by a small amount?

An investor goes long 1 ABC Jan 60 call at $4 and long 1 ABC Jan 60 put at $5 when ABC’s market price is $60. What is the gain or loss if ABC’s market price rises to $69?

Answer = $0 (breakeven)

| Action | Result |

|---|---|

| Buy call | -$400 |

| Buy put | -$500 |

| Exercise call - buy shares | -$6,000 |

| Sell shares | +$6,900 |

| Total | $0 |

At $69, the call is “in the money” and the put is “out of the money.” The put expires worthless, and the call is exercised to buy at $60 and sell at $69. That’s a $9 gain per share, or $900 total ($9 x 100 shares). The $900 combined premium paid upfront exactly offsets the gain, so the result is breakeven.

This is one of two breakeven points for the straddle. On the upside, breakeven occurs when the stock price equals:

In this example: $60 + $9 = $69.

Let’s try another example.

What happens if the market rises by a small amount?

An investor goes long 1 ABC Jan 60 call at $4 and long 1 ABC Jan 60 put at $5 when ABC’s market price is $60. What is the gain or loss if ABC’s market price rises to $62?

Answer = $700 loss

| Action | Result |

|---|---|

| Buy call | -$400 |

| Buy put | -$500 |

| Exercise call - buy shares | -$6,000 |

| Sell shares | +$6,200 |

| Total | -$700 |

At $62, the call is “in the money” and the put is “out of the money.” Exercising the call creates a $2 gain per share, or $200 total ($2 x 100 shares). After subtracting the $900 combined premium, the investor has a $700 loss.

This is the key risk of a long straddle: if the stock doesn’t move enough, the intrinsic value gained won’t cover the two premiums.

What happens if the market remains flat?

An investor goes long 1 ABC Jan 60 call at $4 and long 1 ABC Jan 60 put at $5 when ABC’s market price is $60. What is the gain or loss if ABC’s market price stays at $60?

Answer = $900 loss

| Action | Result |

|---|---|

| Buy call | -$400 |

| Buy put | -$500 |

| Total | -$900 |

At $60, both options are “at the money,” so both expire worthless (an option must have intrinsic value to be exercised). The investor loses the entire $900 paid in premiums.

This is the maximum loss scenario: the stock finishes exactly at the shared strike price.

To find the maximum loss for any long straddle, you can use this formula:

What happens if the market falls a small amount?

An investor goes long 1 ABC Jan 60 call at $4 and long 1 ABC Jan 60 put at $5 when ABC’s market price is $60. What is the gain or loss if ABC’s market price falls to $57?

Answer = $600 loss

| Action | Result |

|---|---|

| Buy call | -$400 |

| Buy put | -$500 |

| Buy shares | -$5,700 |

| Exercise put - sell shares | +$6,000 |

| Total | -$600 |

At $57, the put is “in the money” and the call is “out of the money.” The call expires worthless. The investor buys shares at $57 and exercises the put to sell at $60, creating a $3 gain per share, or $300 total ($3 x 100 shares). After subtracting the $900 combined premium, the investor has a $600 loss.

Again, the move wasn’t large enough for the in-the-money option to overcome the cost of both premiums.

What happens if the market falls a little further?

An investor goes long 1 ABC Jan 60 call at $4 and long 1 ABC Jan 60 put at $5 when ABC’s market price is $60. What is the gain or loss if ABC’s market price falls to $51?

Answer = $0 (breakeven)

| Action | Result |

|---|---|

| Buy call | -$400 |

| Buy put | -$500 |

| Buy shares | -$5,100 |

| Exercise put - sell shares | +$6,000 |

| Total | $0 |

At $51, the put is “in the money” and the call is “out of the money.” The call expires worthless. The investor buys shares at $51 and sells at $60 via the put, creating a $9 gain per share, or $900 total ($9 x 100 shares). The $900 combined premium offsets the gain, so the result is breakeven.

This is the downside breakeven. On the downside, breakeven occurs when the stock price equals:

In this example: $60 − $9 = $51.

Here’s the general formula for breakeven on straddles:

You’ll learn more about this in the next section, but the breakeven formula is the same for both long and short straddles.

Straddles are one of the only options strategies with multiple breakevens. To find both quickly:

In summary, the two breakevens for this long straddle are $51 and $69.

What happens if the market falls significantly?

An investor goes long 1 ABC Jan 60 call at $4 and long 1 ABC Jan 60 put at $5 when ABC’s market price is $60. What is the gain or loss if ABC’s market price falls to $25?

Answer = $2,600 gain

| Action | Result |

|---|---|

| Buy call | -$400 |

| Buy put | -$500 |

| Buy shares | -$2,500 |

| Exercise put - sell shares | +$6,000 |

| Total | +$2,600 |

At $25, the put is “in the money” and the call is “out of the money.” The call expires worthless. The investor buys shares at $25 and sells at $60 via the put, creating a $35 gain per share, or $3,500 total ($35 x 100 shares). The $900 combined premium reduces the gain to $2,600.

Only one option finished in the money, but the move was large enough that the put’s intrinsic value more than offset the $900 total premium.

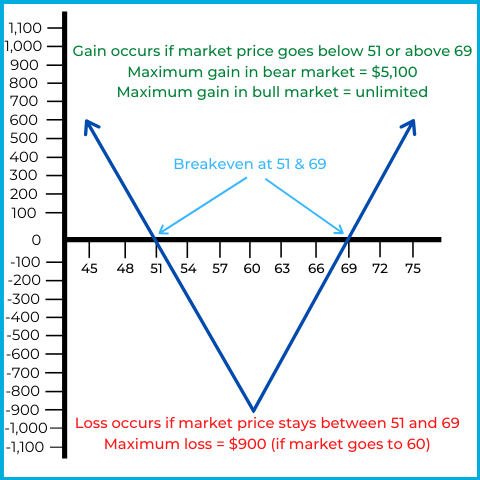

Let’s look at the options payoff chart to summarize the big picture for this long straddle. First, here’s the example again:

Long 1 ABC Jan 60 call @ $4

Long 1 ABC Jan 60 put @ $5

Here’s the payoff chart:

The horizontal axis represents the market price of ABC stock, while the vertical axis represents overall gain or loss.

As the payoff chart shows, the maximum loss of $900 occurs when ABC finishes at $60. At that price, both options expire worthless, so the combined premiums become the total loss.

At $69, the call has $9 of intrinsic value, which offsets the $9 combined premium. Any price above $69 produces a profit, and the upside gain potential is unlimited.

At $51, the put has $9 of intrinsic value, which offsets the $9 combined premium. Any price below $51 produces a profit, and the downside gain potential is up to $5,100 (which would occur if the stock fell to $0).

In the last few examples, we’ll look at what happens when the investor closes out the contracts at intrinsic value. As you’ve learned, closing out means trading the contracts (selling them) instead of exercising them or letting them expire.

An investor goes long 1 ABC Jan 60 call at $4 and long 1 ABC Jan 60 put at $5 when ABC’s market price is $60. ABC’s market falls to $45 and the investor closes the contracts at intrinsic value. What is the gain or loss?

Answer = $600 gain

| Action | Result |

|---|---|

| Buy call | -$400 |

| Buy put | -$500 |

| Close call | $0 |

| Close put | +$1,500 |

| Total | +$600 |

At $45, the put is “in the money” and the call is “out of the money.” The call has $0 of intrinsic value, so it’s closed by selling it for $0 (closing sale). The put has $15 of intrinsic value, so it’s closed by selling it for $15 (closing sale).

The investor paid $9 total in premiums and sells the put for $15, creating a $6 gain per share, or $600 total ($6 x 100 shares).

As a reminder, closing out means doing the opposite of the opening transaction. Since both options were bought to open the straddle (opening purchases), both must be sold to close (closing sales).

Let’s examine one more closing example:

An investor goes long 1 ABC Jan 60 call at $4 and long 1 ABC Jan 60 put at $5 when ABC’s market price is $60. ABC’s market rises to $66 and the investor closes the contracts at intrinsic value. What is the gain or loss?

Answer = $300 loss

| Action | Result |

|---|---|

| Buy call | -$400 |

| Buy put | -$500 |

| Close call | +$600 |

| Close put | $0 |

| Total | -$300 |

At $66, the call is “in the money” and the put is “out of the money.” The put has $0 of intrinsic value, so it’s closed by selling it for $0 (closing sale). The call has $6 of intrinsic value, so it’s closed by selling it for $6 (closing sale).

The investor paid $9 total in premiums and sells the call for $6, creating a $3 loss per share, or $300 total ($3 x 100 shares).

As in the prior example, both options were bought to open the straddle, so both must be sold to close.

This video covers the important concepts related to long straddles:

For suitability, long straddles should only be recommended to aggressive options traders if volatility is expected. Although the maximum loss is limited to the premiums, losses can add up quickly due to the short-term nature of options. The investor realizes a loss if volatility does not materialize before expiration (9 months or less for standard options).

Sign up for free to take 6 quiz questions on this topic