This chapter covers the fundamentals of long put options contracts. To get comfortable with the language used when discussing options, watch this video:

When an investor goes long a put, they’re bearish on the underlying security’s market price. Buying a put gives the holder the right to sell the stock at the strike price.

Let’s work through a few examples to understand long puts better:

Long 1 ABC Sep 75 put @ $6

This contract gives the right to sell ABC stock at $75 per share. The option costs $600 ($6 × 100 shares) and expires on the third Friday in September. The investor is betting ABC’s market price will fall below $75 before expiration. If it doesn’t, the option expires and the investor loses the $600 premium.

Math-based options questions should be expected on the exam. They typically ask about potential gains, losses, and breakeven values. Let’s go through each.

The maximum gain for a long put occurs if the market price falls to zero. Here’s what that looks like:

An investor goes long 1 ABC Sep 75 put @ $6. The market price falls to $0. What is the gain or loss?

Can you figure it out?

Answer = $6,900 gain

| Action | Result |

|---|---|

| Buy put | -$600 |

| Buy shares | -$0 |

| Exercise - sell shares | +$7,500 |

| Total | +$6,900 |

At $0, the option is $75 “in the money.” Stock going to zero is uncommon, but it can happen. To realize the maximum gain, the investor buys 100 ABC shares in the market for $0 (the stock is worthless). Then they exercise the put and sell those 100 shares for $75 per share.

A long put’s maximum gain can be calculated with this formula:

The strike price of $75 minus the premium of $6 gives a maximum gain of $69 per share (or $6,900 overall).

Let’s look at an example that’s more likely to occur:

An investor goes long 1 ABC Sep 75 put @ $6. The market price falls to $60. What is the gain or loss?

Answer = $900 gain

| Action | Result |

|---|---|

| Buy put | -$600 |

| Buy shares | -$6,000 |

| Exercise - sell shares | +$7,500 |

| Total | +$900 |

At $60, the option is $15 “in the money.” The investor buys 100 ABC shares at $60 in the market, then exercises the put and sells those shares at $75.

Put holders don’t always make a profit. Even if ABC’s market price falls below $75, the investor still has to earn back the premium to have an overall gain.

Let’s look at another example:

An investor goes long 1 ABC Sep 75 put @ $6. The market price falls to $69. What is the gain or loss?

Answer = $0 (breakeven)

| Action | Result |

|---|---|

| Buy put | -$600 |

| Buy shares | -$6,900 |

| Exercise - sell shares | +$7,500 |

| Total | $0 |

At $69, the option is $6 “in the money.” The investor buys 100 ABC shares at $69, then exercises the put and sells at $75.

At this price, the put has intrinsic value, but not enough to produce an overall profit after the premium.

When investing in puts, the breakeven can be found using this formula:

With a strike price of $75 and a premium of $6, the investor breaks even when ABC stock is at $69 per share. At this market value, there is no profit or loss.

The investor can still have a loss if ABC’s market price doesn’t fall far enough below $75. For example:

An investor goes long 1 ABC Sep 75 put @ $6. The market price falls to $74. What is the gain or loss?

Answer = $500 loss

| Action | Result |

|---|---|

| Buy put | -$600 |

| Buy shares | -$7,400 |

| Exercise - sell shares | +$7,500 |

| Total | -$500 |

At $74, the option is $1 “in the money.” The investor buys 100 shares at $74, then exercises the put and sells at $75.

Even though the put has intrinsic value, it isn’t enough to offset the premium.

Expiration is the worst-case scenario for investors holding long options. If the option expires worthless, the investor paid a premium for a contract they never use. The same applies to long put contracts.

An investor goes long 1 ABC Sep 75 put @ $6. The market price rises to $84. What is the gain or loss?

Answer = $600 loss

| Action | Result |

|---|---|

| Buy put | -$600 |

| Total | -$600 |

At $84, the option is $9 “out of the money” and has no intrinsic value. When the market price is above $75, exercising doesn’t make sense: the investor would be selling for $75 when the market is paying $84. So the investor lets the contract expire and loses the premium (the maximum potential loss).

Long options can only lose the amount spent on the premium. If exercising would create a loss, the investor will let the option expire.

Investors can also perform closing transactions to close their options before expiration.

An investor goes long 1 ABC Sep 75 put @ $6. After ABC’s market price rises to $79, the premium falls to $2, and the investor performs a closing sale. What is the gain or loss?

Answer = $400 loss

| Action | Result |

|---|---|

| Buy put | -$600 |

| Close put | +$200 |

| Total | -$400 |

The market price increased, causing the option premium to fall. Premiums aren’t fixed - they fluctuate like stock prices. The premium was $6 when the put was purchased, and later it fell to $2, which is the price received when the investor liquidated the option (closing sale).

The investor bought the put at $6 and sold it at $2, for a $4 per share loss. Since option premiums represent 100 shares, the overall loss is $400. For closing transactions, compare the premium paid to the premium received.

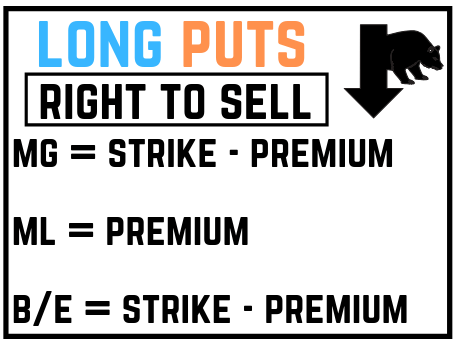

Here’s a visual summarizing the important aspects of long puts:

Sign up for free to take 12 quiz questions on this topic