This chapter covers the fundamentals of long put options contracts. To get comfortable with the language used when discussing options, watch this video:

When an investor goes long a put, they’re bearish on the underlying security’s market price. Buying a put gives the holder the right to sell the stock at the strike price.

Let’s work through a few examples to understand long puts:

Long 1 ABC Sep 75 put @ $6

This contract gives the right to sell ABC stock at $75 per share. The option costs $600 ($6 × 100 shares) and expires on the third Friday in September.

The investor is betting that ABC’s market price will fall below $75 before expiration. If it doesn’t, the option expires worthless, and the investor loses the $600 premium.

Math-based options questions should be expected on the exam. They typically ask about potential gains, losses, and breakeven values. Let’s go through each.

The maximum gain for a long put occurs if the stock’s market price falls to zero. Here’s what that looks like:

An investor goes long 1 ABC Sep 75 put @ $6. The market price falls to $0. What is the gain or loss?

Can you figure it out?

Answer = $6,900 gain

| Action | Result |

|---|---|

| Buy put | -$600 |

| Buy shares | -$0 |

| Exercise - sell shares | +$7,500 |

| Total | +$6,900 |

At $0, the option is $75 in the money. Stock going to zero is uncommon, but it can happen.

To realize the maximum gain, the investor:

That exercise creates a $7,500 gain ($75 × 100). After subtracting the $600 premium paid upfront, the net gain is $6,900.

A long put’s maximum gain can be calculated with this formula:

The strike price of $75 minus the premium of $6 gives a maximum gain of $69 per share (or $6,900 overall).

Let’s look at an example that’s more likely to occur:

An investor goes long 1 ABC Sep 75 put @ $6. The market price falls to $60. What is the gain or loss?

Answer = $900 gain

| Action | Result |

|---|---|

| Buy put | -$600 |

| Buy shares | -$6,000 |

| Exercise - sell shares | +$7,500 |

| Total | +$900 |

At $60, the option is $15 in the money. The investor:

That locks in a $1,500 gain ($15 × 100). After subtracting the $600 premium, the net gain is $900.

Put holders don’t always make a profit. Even if ABC’s market price falls below $75, the holder must recover the premium to have an overall gain.

Let’s look at another example:

An investor goes long 1 ABC Sep 75 put @ $6. The market price falls to $69. What is the gain or loss?

Answer = $0 (breakeven)

| Action | Result |

|---|---|

| Buy put | -$600 |

| Buy shares | -$6,900 |

| Exercise - sell shares | +$7,500 |

| Total | $0 |

At $69, the option is $6 in the money. The investor buys 100 ABC shares at $69, then exercises the put and sells them at $75.

The $600 gain from exercising exactly offsets the $600 premium, so the result is breakeven.

When investing in puts, the breakeven can be found using this formula:

With a strike price of $75 and a premium of $6, the investor breaks even when ABC stock is at $69 per share. At this market value, there is no profit or loss.

The investor can still have a loss if ABC’s market price doesn’t fall far enough below $75. For example:

An investor goes long 1 ABC Sep 75 put @ $6. The market price falls to $74. What is the gain or loss?

Answer = $500 loss

| Action | Result |

|---|---|

| Buy put | -$600 |

| Buy shares | -$7,400 |

| Exercise - sell shares | +$7,500 |

| Total | -$500 |

At $74, the option is $1 in the money. The investor buys 100 shares at $74, then exercises the put and sells them at $75.

The $100 gain doesn’t offset the $600 premium, so the net result is a $500 loss.

Expiration is the worst-case scenario for investors holding long options. In that case, the investor pays a premium for an option that is never used. The same applies to long put contracts.

An investor goes long 1 ABC Sep 75 put @ $6. The market price rises to $84. What is the gain or loss?

Answer = $600 loss

| Action | Result |

|---|---|

| Buy put | -$600 |

| Total | -$600 |

At $84, the option is $9 out of the money and has no intrinsic value. When the market price is above $75, exercising makes no sense - selling for $75 is worse than selling in the market for $84.

So the investor lets the contract expire and loses the premium paid. This is the maximum possible loss for a long put.

Long options can only lose the amount spent on the premium. If exercising would create a loss, the investor will let the option expire.

Investors can also perform closing transactions to close their options before expiration.

An investor goes long 1 ABC Sep 75 put @ $6. After ABC’s market price rises to $79, the premium falls to $2, and the investor performs a closing sale. What is the gain or loss?

Answer = $400 loss

| Action | Result |

|---|---|

| Buy put | -$600 |

| Close put | +$200 |

| Total | -$400 |

The market price increased, causing the option premium to fall. Premiums aren’t fixed - they fluctuate like stock prices.

That’s a $4 per share loss, or $400 overall ($4 × 100). For closing transactions, compare the premium paid to the premium received.

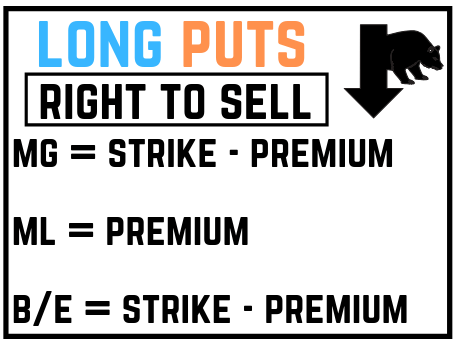

Here’s a visual summarizing the important aspects of long puts:

Sign up for free to take 12 quiz questions on this topic