Long calls

This chapter covers the fundamentals of long call options contracts. To get comfortable with the language used when discussing options, watch this video:

When an investor goes long a call, they’re bullish on the underlying security’s market price. Buying a call gives the holder the right (but not the obligation) to buy the stock at the strike price.

- If the stock’s market price rises above the call’s strike price, the holder can potentially profit by exercising the option (the call is in the money).

- If the market price stays below the strike price, the holder won’t exercise and will realize a loss equal to the premium paid (the call is out of the money).

Let’s work through a few examples to understand long calls better.

Long 1 ABC Sep 75 call @ $6

This contract gives the right to buy ABC stock at $75 per share. The option costs $600 ($6 × 100 shares) and expires on the third Friday in September. The investor is expecting ABC’s market price to rise above $75 before expiration. If it doesn’t, the option expires and the investor loses the $600 premium.

Math-based options questions should be expected on the exam. They typically ask about potential gains, losses, and breakeven values. Let’s go through each.

A long call’s maximum gain is unlimited. The contract above allows the investor to buy 100 ABC shares at $75 any time before expiration. If the market price rises, the investor can exercise, buy at $75, and then sell at the higher market price. As the market price keeps rising, the potential profit keeps increasing.

For the following examples, assume the investor sells the shares immediately after exercising.

An investor goes long 1 ABC Sep 75 call @ $6. The market price rises to $100. What is the gain or loss?

Answer = $1,900 gain

| Action | Result |

|---|---|

| Buy call | -$600 |

| Exercise - buy shares | -$7,500 |

| Sell shares | +$10,000 |

| Total | +$1,900 |

At $100, the call is $25 in the money ($100 − $75). The investor exercises, buys 100 shares for $75 per share, and immediately sells them for $100 per share.

- Profit from exercising and selling shares: $25 × 100 = $2,500

- Subtract the premium paid: $2,500 − $600 = $1,900

Even if ABC’s market price rises above $75, the investor might still not profit if the increase isn’t enough to cover the premium.

An investor goes long 1 ABC Sep 75 call @ $6. The market price rises to $81. What is the gain or loss?

Answer = $0 (breakeven)

| Action | Result |

|---|---|

| Buy call | -$600 |

| Exercise - buy shares | -$7,500 |

| Sell shares | +$8,100 |

| Total | $0 |

At $81, the call is $6 in the money ($81 − $75). Exercising creates a $600 gain on the shares ($6 × 100), but the investor paid a $600 premium upfront. Those offset, so the result is breakeven.

When investing in calls, the breakeven can be found using this formula:

With a strike price of $75 and a premium of $6, the breakeven is $81. At this market price, there is no profit or loss.

If the market price doesn’t rise far enough above $75, the investor can still have a loss even though the call is in the money.

An investor goes long 1 ABC Sep 75 call @ $6. The market price rises to $79. What is the gain or loss?

Answer = $200 loss

| Action | Result |

|---|---|

| Buy call | -$600 |

| Exercise - buy shares | -$7,500 |

| Sell shares | +$7,900 |

| Total | -$200 |

At $79, the call is $4 in the money ($79 − $75). Exercising creates a $400 gain on the shares ($4 × 100), but the $600 premium is larger, so the net result is a $200 loss.

Expiration is the worst-case outcome for a long option: the investor paid a premium for a contract that is never used.

An investor goes long 1 ABC Sep 75 call @ $6. The market price falls to $73. What is the gain or loss?

Answer = $600 loss

| Action | Result |

|---|---|

| Buy call | -$600 |

| Total | -$600 |

At $73, the call is out of the money because the market price is below the $75 strike price. Exercising would mean paying $75 for a stock that’s available in the market for $73, so the investor lets the option expire. The loss is the premium paid.

Long options can only lose the amount spent on the premium. If exercising would create a loss, the investor will let the option expire.

Investors can also perform closing transactions to exit their options before expiration.

An investor goes long 1 ABC Sep 75 call @ $6. After ABC’s market price rises to $79, the premium rises to $9, and the investor performs a closing sale. What is the gain or loss?

Answer = $300 gain

| Action | Result |

|---|---|

| Buy call | -$600 |

| Close call | +$900 |

| Total | +$300 |

The option premium increased from $6 to $9. Premiums fluctuate with market conditions, including changes in the underlying stock price.

To find profit or loss on a closing transaction, compare the premium paid to the premium received:

- Gain per share: $9 − $6 = $3

- Total gain: $3 × 100 = $300

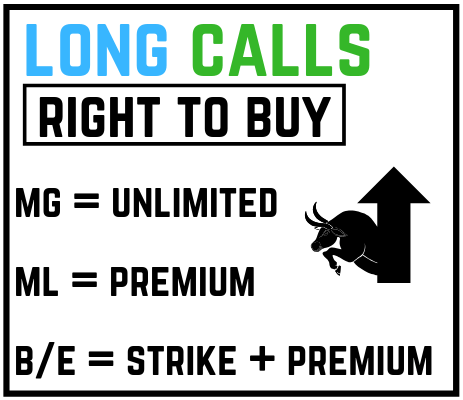

Here’s a visual summarizing the important aspects of long calls: